Future Food Quick Bites: Meaty Concerts, Livestock Liability & A Salmon Song

10 Mins Read

In our weekly column, we round up the latest news and developments in the alternative protein and sustainable food industry. This week, Future Food Quick Bites covers Beyond Meat’s Madison Square Garden link-up, Kaufland’s price drops following Lidl’s lead, and a bunch of livestock farming developments.

New products and launches

Just after launching its new health-focused ad campaign, plant-based meat giant Beyond Meat has opened a concession stand at New York’s Madison Square Garden (MSG), part of a larger partnership with the group that will see its products available at the MSG garden during sports, concerts and other live events.

In further plant-based advertising news, Singapore-based TiNDLE Foods is launching its first TV spot in Germany, after entering that market earlier this year- in June, the plant-based meat startup announced a media-for-equity deal with SevenVentures, the investment arm of ProSiebenSat.1, Germany’s largest media and digital company. TiNDLE also shared it is partnering with burger chain Peter Pane to introduce seven vegan meat dishes on the menu.

Meanwhile, French whole-cut vegan chicken maker Umiami – plant-based poulet, as we described it – has announced plans to break into the US market with a headquarters in Chicago. It comes weeks after the company extended its Series A investment with a $34.7M cash injection.

Another whole-cut plant-based meat brand, Slovenia’s Juicy Marbles has been spotted at Whole Foods in the US, which featured its thick-cut steaks.

And in yet more whole-cut developments, Israel’s Chunk Foods launched into Philadelphia earlier this month, starting with the restaurant Monster Vegan, which will use the meat to make a Chunk Short Rib Ragu. Chunk launched into Charley’s Steak House in August, and on the back of that success, it’s now appearing on the menus of other Talk of the Town restaurants, which is Charley’s parent group.

Want more foodservice updates? Plenty more this week! Hong Kong-based OmniFoods is partnering with Neat Burger to add a fish sandwich and a fish and chips option to the latter’s New York City menu, featuring the Omni Golden Fillet.

Meanwhile, US fast-casual chain Veggie Grill unveiled its 2.0 avatar with a revamped menu and feel-good food. Think Sesame Tofu Supergreens Salad and Ranchero Bean Fiesta Bowl. If you visit one of its 17 locations this month, you’ll get a sweet two-for-one deal.

Elsewhere, after launching its York-style plant-based ham slices, Heura is hosting a charcuterie pop-up in Barcelona next week to try the new product. It will be open from 10am to 7:30pm at the Mercat de Santa Caterina on October 20.

In South Korea, Unlimeat has partnered with US plant-based egg giant Just Egg to launch a vegan kimbap delivery service in the Gangnam and Seocho districts. The collaboration began in August, with the new Kimbap items receiving overwhelmingly positive feedback.

Frozen food giant McCains has collaborated with F&B consultants The Culinary Edge (both American) to form a new plant-based appetiser brand called V’DGZ, starting with a portfolio of cauliflower wings, crispy corn ribs and crunchy Brussels sprouts.

In last week’s Future Food Quick Bites, we reported on Eleven Madison Park‘s Hong Kong residency in its 25th year. The mostly-plant-based, three-Michelin-starred New York City eatery is celebrating its silver anniversary with a retrospective menu looking back at its greatest hits from a meatless lens: grilled maitake mushroom skewer with juniper and pine, vegan ricotta tonburi with avocado and cucumber, and even bread and sunflower butter. Its chef-owner Daniel Humm has introduced Climax Foods’ artisan vegan blue cheese on the tasting menu, which runs till the end of the month.

Speaking of New York City, the city’s coffee festival saw molecular coffee startup Atomo serve its beanless caffeine drink to industry experts and aficionados – a big step for the coffee alternative space.

And what better to have with your alt-coffee than alt-milk? Singaporean oat milk brand Oatside, which has taken Asia’s plant-based milk space by storm, is launching its pocket-sized 200ml cartons at over 700 7-Eleven stores in Hong Kong. These will be available in coffee and chocolate flavours, as well as a barista edition.

Another brand launching across more retail stores is Minneapolis-based vegan brand Wicked Kitchen, which has expanded from its Tesco-only deal in the UK to now launch into Asda (the number of locations is unclear for now).

Another retailer, meanwhile, followed Lidl’s lead to bring its plant-based own-label range to price parity with animal-derived foods. German supermarket Kaufland is dropping prices of over 90 vegan products, with vegan cheese coming down from €1.99 to €1.39, soy yoghurt dropping from €1.39 to 85 cents, and plant-based mince falling from €2.99 to €1.89.

Funding, M&A and policy activity

Just calm down, you plant-based meat detractors. New research says the global meat alternative market reached $6.5B in 2022, and expects it to grow and cross $9.5B in 2028 – a 6.6% yearly increase. According to the report, Europe is the largest market here, and rising health consciousness among consumers is a key factor in this sector’s growth. Of course, this is just one market insight – let’s see how things pan out!

As for things that have panned out splendidly, French plant-based pork brand La Vie – which launched its ham alongside a crowdfunding campaign last month – says it’s the most popular French crowdfunding campaign ever, with 2,945 investors raising €2,172,890 ($2.29M).

Also in France, vegan fast-food chain Furahaa has launched its own public funding drive, with a target of €1M and hopes to open 30 franchise stores in 2024.

Meanwhile, Spanish vegan ice cream brand Pink Albatross is opening a financing round too, aiming to raise between €1M and €1.5M to focus on new product development, increased marketing, recruitment and maintenance of working capital.

In Catalonia, the government has injected €7M into a Center for Innovation in Alternative Proteins, which aims to be a leading R&D hub for ingredients and feed alternatives to animal proteins.

Government spending on future foods was seen in the UK too, where 47 winners of the Innovate UK Better Food for All competition will each receive a share of £17.4M to improve food quality and nutrition, develop functional foods and new proteins, and extend the shelf life of healthy and fresh foods.

Talking about novel proteins, Australian company Wide Open Agriculture has acquired German lupin protein company Prolupin for $4.12M to become the world’s largest producer of the protein and expand its footprint into Europe.

Australia’s $160M Food and Beverage Accelerator, meanwhile, announced a partnership with alt-dairy startup All G Foods to develop nature-identical dairy proteins and ingredients via precision fermentation.

Elsewhere, Berkeley-based precision fermentation producer Pow.Bio raked in $9.5M in Series A funding to bring down the production costs of these proteins. It uses what it claims is the first AI-controlled autonomous continuous fermentation platform.

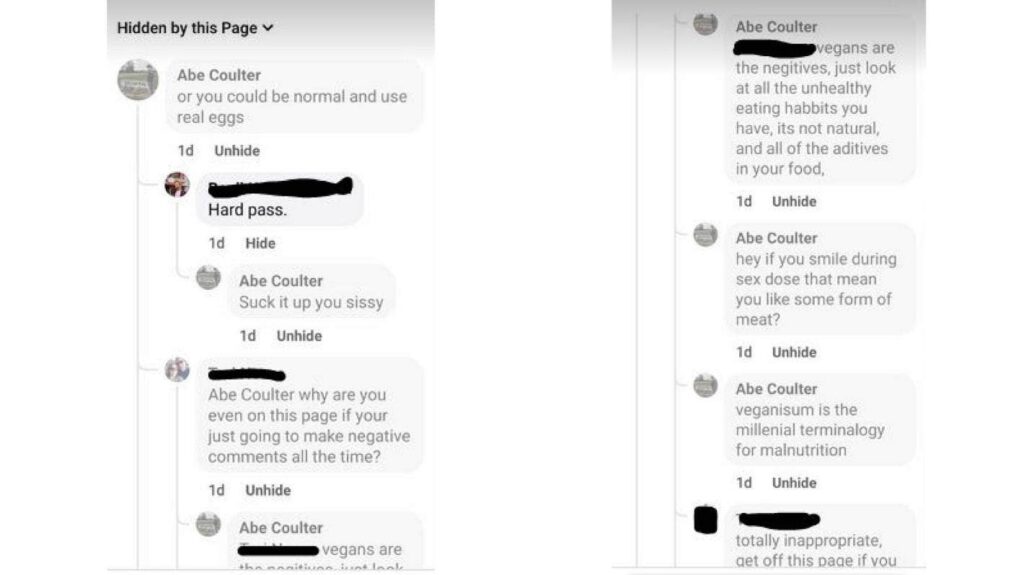

In New Zealand, New Conservative candidate Abe Coulter has been under the spotlight after it emerged that he mocked vegans on social media comments, harassing them, calling them abnormal, and mocking them about sex. The comments have since been blocked, but stuff like “suck it up you sissy” asking people to eat eggs or “veganisum [sic] is the millenial terminalogy [sic] for malnutrition” show that Abe might need to work on both his PR and grammar.

Across the Pacific, California became the first state government to ban four food additives linked to diseases, despite them being approved by the FDA. From 2027, food products sold in the state won’t be allowed to contain brominated vegetable oil, potassium bromate, propylparaben or Red Dye No. 3 – which have been linked to hyperactivity, nervous system damage and increased cancer risk.

Meanwhile, the 2023 International V-Label Awards announced its shortlist of 15 finalists from over 230 entries across the tangents of sustainability, innovation, and marketing and branding. Note: Green Queen founder and editor in chief Sonalie Figueiras was part of the judging panel.

Animal agriculture and manufacturing news

We had to add a dedicated section to this as there was so much – mostly not great stuff – happening in this space. For example, US pork producer Smithfields closed a North Carolina plant to “increase efficiency” and “better utilise existing capacity”. It will affect 107 employees – in total, the company has a workforce of over 10,000 in North Carolina, which represents a quarter of its entire staff.

Then there’s Monogram Meat Snacks, which has been fined over $140,000 by the US Department of Labor and has seen shipping restrictions imposed on account of child labour. At one Minnesota factory, 11 children aged 15-17 were found to be employed illegally, with at least nine operating hazardous equipment.

Meanwhile, as Thanksgiving approaches, turkey prices could be lower than last year, when the bird’s population suffered from an avian flu outbreak. But as turkey numbers have been restored, the virus has returned and could once again affect supplies.

In Australia, we’ve come to a point where farmers have too long of a wait time to slaughter their livestock, with feedlots and abattoirs overwhelmed by drier conditions low commodity prices and labour constraints.

In the UK, chefs are boycotting salmon – often called the “chicken of the sea” – over welfare and climate-related concerns. Overfishing and the use of antibiotics and chemicals have deterred Britain’s leading chefs, who cite ethical and quality concerns for keeping the fish off the menu.

In other salmon news, Icelandic singer Björk has collaborated with Catalan popstar Rosaliá on a new (untitled) song to save wild salmon populations in Iceland, donating proceeds to activists opposing the industrial farming of the fish in the country.

Speaking of protests against industrial farming, the Netherlands witnessed demonstrations from Greenpeace and Extinction Rebellion, who rallied in front of Rabobank branches across the country last week to ask the bank to cease its industrial agriculture investments and compensate for the damage caused.

In the vein of brands with shaky animal welfare commitments, a new report by The Humane League and Open Wing Alliance has called out brands that aren’t delivering on their 100% cage-free egg commitments. These include Shake Shack, Ikea, The Cheesecake Factory and Krispy Kreme.

Novel tech and research

US company MycoTechnology has released what it calls a Fermentation as a Service (FaaS) platform, helping companies overcome capacity bottlenecks and scale up their fermentation operations.

In Europe, Dutch food tech startup Vaess and UK’s Marlow Ingredients (a spin-off of Marlow Foods, which makes Quorn) have collaborated to develop binding systems for mycoprotein products. The brands say they will use each other’s experience to make high-quality mycoprotein-based meat alternatives.

Germany’s University of Hohenheim, meanwhile, is developing plant-based fish products from microalgae, which would be naturally rich in omega-3 fatty acids. Miroalgae’s ability to bind carbon means and grow in multiple regions gives it bonus climate brownie points, and the researchers have developed a fermentation process using mushrooms to break down the often-undesirable flavour compounds found in the ingredient.

More on the fermentation front: Gingko Bioworks collaborated with Swiss food tech firm QL AG to develop alternative dairy proteins. QL AG will tap into Ginkgo’s strain engineering capabilities to help it produce high-quality, nutritionally equivalent dairy proteins.

In cultivated protein news, BioCraft Pet Nutrition has unveiled an AI and machine learning tool to accelerate R&D and achieve optimal cell proliferation and nutrient production. It can identify cheaper inputs and ingredients too, as well as those less likely to raise regulatory concerns – a big step for any cultured meat company.

Meanwhile, in South Korea CJ Foods – a business unit of food ingredients manufacturer CJ CheilJedang – has teamed up with medtech company T&R Biofab to develop 3D-printed plant-based meat alternatives.

And finally, in slightly left-field news, a survey by vegan dating app Veggly has found that 75% of plant-based people would date a meat-eater who is willing to transition to a vegan diet with some help from their would-be partner. See, we can “suck it up”, Abe.

Want more roundups of alt-protein, plant-based and sustainable food? Stay tuned for next week’s Future Food Quick Bites, published every Wednesday, or get it in your mailbox by signing up for our Alt Protein Weekly newsletter.

Check out last week’s Future Food Quick Bites.