2023 State of the Marketplace: 8 Takeaways for Plant-Based Brands from PBFA’s Latest Report

8 Mins Read

Health, e-commerce and almond milk are vital in a sector that shows long-term potential despite recent headwinds, according to a new report by the Plant-Based Foods Association.

In spite of a rough year for sales and investment in the vegan sector, if certain barriers are removed, plant-based food is here to stay. That’s the consensus of the 2023 State of the Marketplace report by US-based trade body the Plant-Based Foods Association (PBFA).

Leveraging data from multiple insight firms, the analysis looks at the retail, foodservice and e-commerce sectors to find the challenges and opportunities for plant-based brands.

“Despite inflationary pressures and economic challenges that have affected the entire food landscape, plant-based has held strong and established its faithful role in the shopping carts, shelves, and menus of a large and diverse group of consumers,” said PBFA’s VP of marketplace development, Julie Emmett.

“The plant-based foods segment remains an important priority offering for our customers that continues to evolve with changing customer trends,” added Lee Robinson, VP of merchandising at Whole Foods Market, a PBFA partner. “Putting the ‘plant’ back in ‘plant-based’ through simpler, plant-forward ingredient decks, elevated sourcing, and reduced processing are areas of focus to usher the industry into advancing agricultural practices.”

What can companies learn from the state of the plant-based marketplace in 2023? Here are the big takeaways.

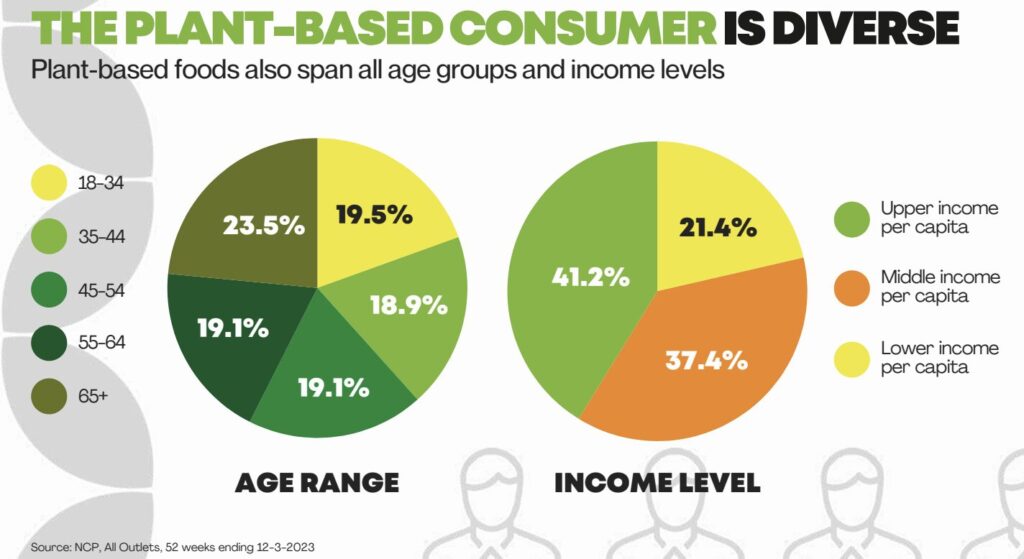

Gen Z doesn’t make up a large majority of plant-based shoppers

The share of vegan consumers is evenly split across age and income demographics. Over-65s actually accounted for the largest share (23.5%), followed by the 18-34 age group (19.5%). So it appears that Gen Zers don’t represent a large majority of plant-based shoppers, although their purchasing power is predicted to grow when 2024 tax changes take effect.

Meanwhile, over 41% of people who buy plant-based have high incomes, a trend that “aligns with unavoidable industry realities”, according to PBFA. Vegan food is still competing with the low prices of industrially farmed, government-subsidy-backed animal foods. But research has shown that plant-based consumers spend more overall, making them highly valuable to retailers and operators.

Additional data shows that 62% of US households are buying plant-based foods, and 81% are repeating these purchases, indicating their strong faith in these products.

Health over everything

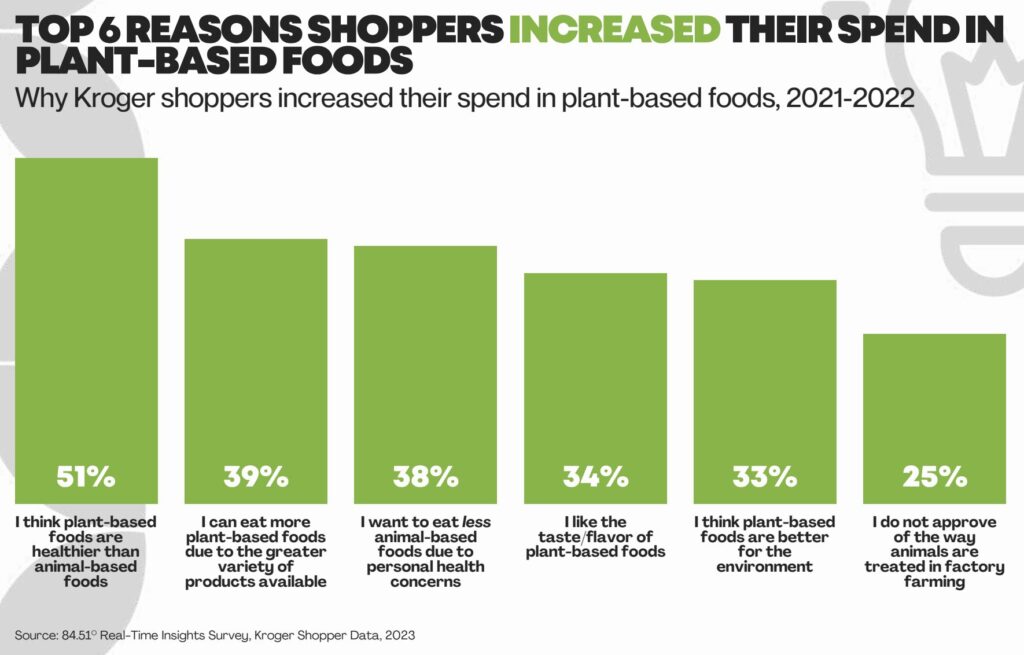

The importance of health has skyrocketed in the post-pandemic and mid-Ozempic eras. Industry leaders are already repositioning their brands to be more health-skewed to meet these needs, and PBFA’s analysis confirms the vitality of health.

The report outlines how health can mean different things to people, spanning personal illness, food safety or even specific nutritional requirements. Among primary US grocer shoppers, 80% consider themselves health-conscious, and 65% eat plant-based because they think these products are healthy.

Similarly, 51% of Kroger shoppers said they buy vegan products since they’re healthy, and 38% do so because they want to reduce animal consumption due to personal health concerns.

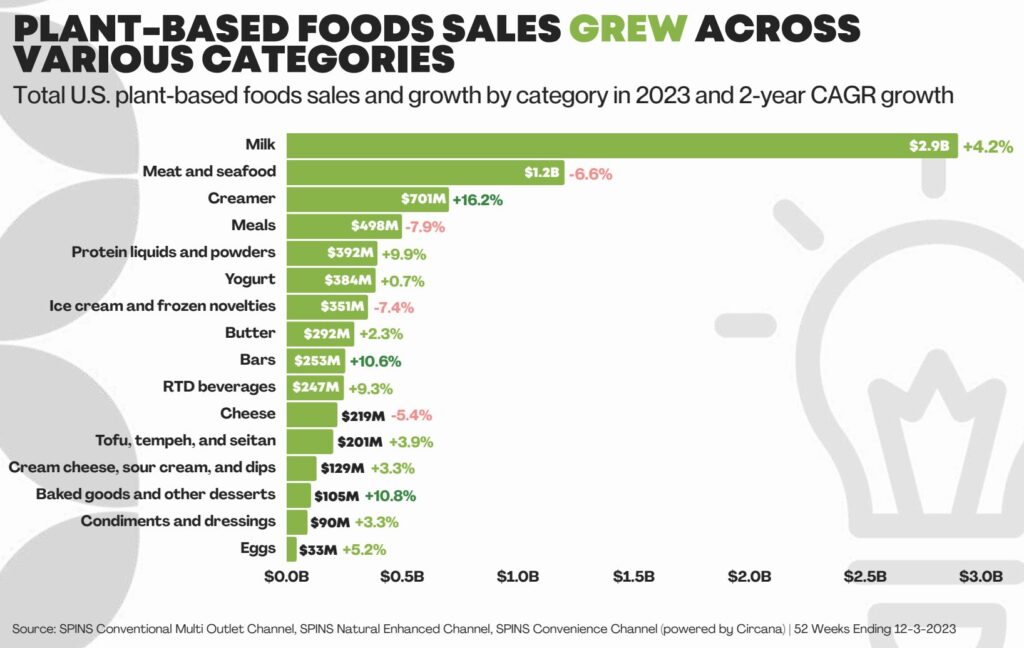

Only four categories actually declined in dollar sales

Despite concerns about the industry’s alleged downfall (if you’re to believe certain media outlets), only four product categories saw sales dip, while the overall sector held relatively steady (down from $8.2B in 2022 to $8.1B in 2023), suggesting that it was a year of flatlines instead of declines.

From 2021 to 2023, meat and seafood (-6.6%), ready meals (-7.9%), ice cream (-7.4%), and cheese (-5.4%) were the only plant-based categories that witnessed a decrease. PBFA recommends that retailers merchandise meat or seafood analogues with products that are frequently purchased together, such as conventional meat/seafood or dairy cheese, as about three in 10 people who buy the former also buy the latter.

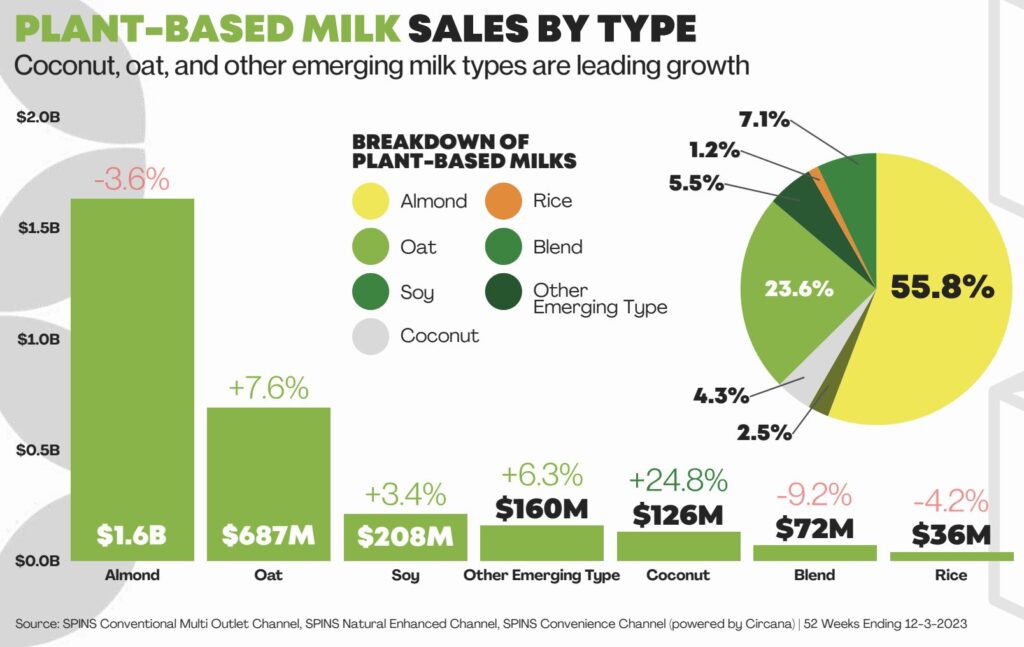

Milk is still the plant-based leader

Plant-based milk is still the leading category in the sector, making up over a third (36%) of all sales last year, and representing a 4.2% annual growth since 2021. In 2023, dollar sales grew slightly by 0.7%, but unit sales dropped by 7.5%, an indication of the higher cost of products (milk alternatives saw prices hike by over 8%).

Still, this category represents the highest dollar share in the overall market (15%) across the plant-based sector. This is even higher (41%) in the natural channel, which entails supermarkets with over $2M of annual sales and at least 50% of sales from natural or organic products (excluding Whole Foods).

Despite a 3.6% decline, almond milk is still the leader in the US, making up 55% ($1.6B) of the category’s total sales. Oat has held strong at second position with a 7.6% increase, while coconut milk saw the largest increase (24.8%).

In foodservice, meanwhile, operators increased their spend on plant-based milk much more than dairy. While they bought 8.2% more conventional milk and spent 7.1% more than the year before, their purchases of plant-based milk grew by 18.3% in volume, representing a 20.9% higher spend.

Watch out for the creamers

Non-dairy creamers are expanding rapidly in the US. It’s a market that has seen constant growth over the years, and saw annual sales increase by 16.2% (the highest in the industry) from 2021 to 2023 to reach $701M. Last year alone, dollar sales were up by 10.4%, and units also increased by 3.7%.

Across the US, 15% of households bought plant-based creamers last year, and over 65% repeated their purchase. Among the 73% of Americans who drink coffee every day, a majority prefer to add creamers and/or sweeteners instead of drinking it black. Here, the preference for oat milk creamers climbed by 90% and almond-based options by 71% since 2022.

“As long as the demand for coffee exists, consumers will search for creamers to go with it – and as environmental awareness grows, consumers may seek out more plant-based options,” the report stated. “Brands and retailers can emphasise plant-based creamers’ environmental benefits to help consumers make choices that are more aligned with their values.”

Don’t sleep on e-commerce

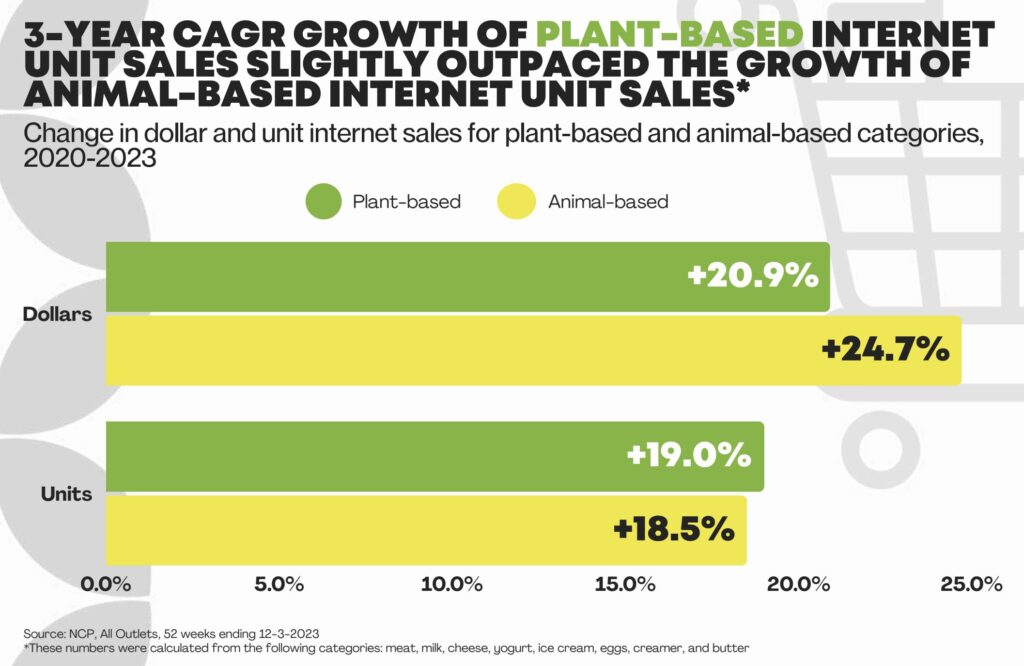

In the US, 33% of shoppers buy plant-based foods online – convenience, a wide array of options, and the absence of physical shelf space constraints make this channel attractive to brands. E-commerce plant-based sales reached $394M in 2023, with an annual growth rate of 16.4% over three years. They also occupy a larger share of online sales (6.8%) than brick-and-mortar retail (3.8%).

And while animal-based foods outpaced vegan categories in dollar sale growth last year, plant-based products actually saw a higher increase in unit sales than their conventional counterparts, illustrating strong, sustained shopper interest and engagement.

Restaurants are down on plant-based – other operators are not

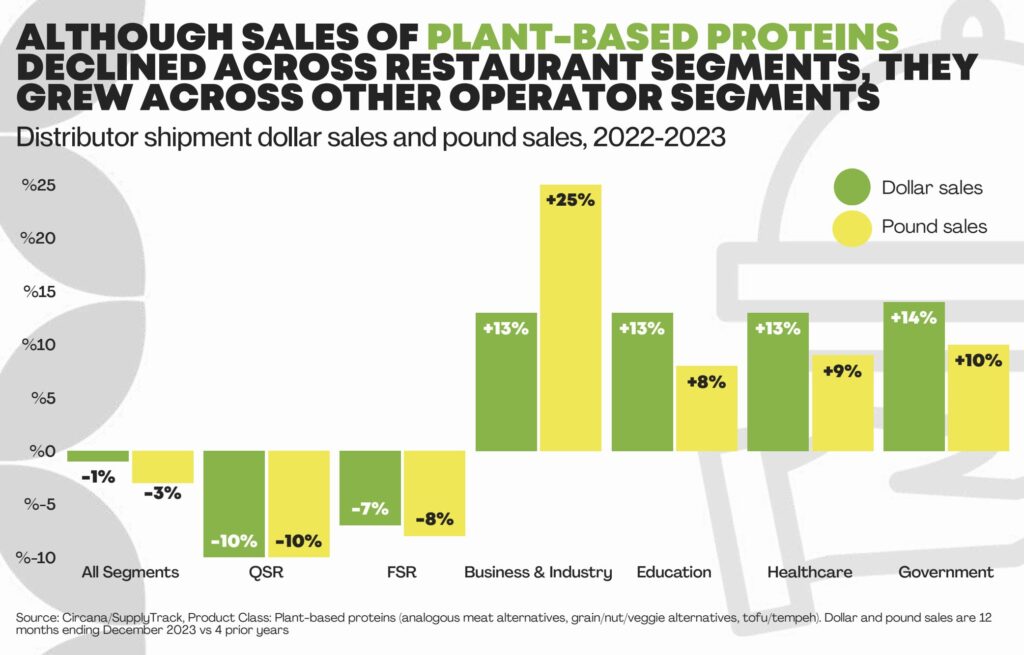

Dollar sales of plant proteins – including meat analogues and traditional food like tofu, tempeh, grains and nuts – in foodservice dipped slightly by 1% last year, with restaurants representing the biggest decline. Quick-service establishments spent 10% less on these foods, and full-service ones shelled out 7% less.

But this was offset by other industry operators – mainly workplace cafeterias, which bought 25% more plant proteins and spent 13% more on them. Dollar and pound sales of plant-based food also increased in education, healthcare and government establishments.

Rob Morasco, VP of innovation at Sodexo, which is aiming to make 50% of its food plant-based by 2025, outlined three main challenges for adding plant-based products to foodservice. “Our customers can be anywhere on the ‘knowledge spectrum’ on these products, especially those that don’t identify as vegan or vegetarian. Educating them on the choices available to them without ‘preaching or dictating’ is very important,” he explained.

“Second, our operators and chefs also need the same education on plant-based overall – whether alt products or whole food plant-based, there is work to do to help our chefs feel more comfortable in this space. Lastly, cost and distribution are still a challenge – normalisation compared to their ordinary alternatives and achieving price parity will be a pretty big deal.”

Different forks, different strokes

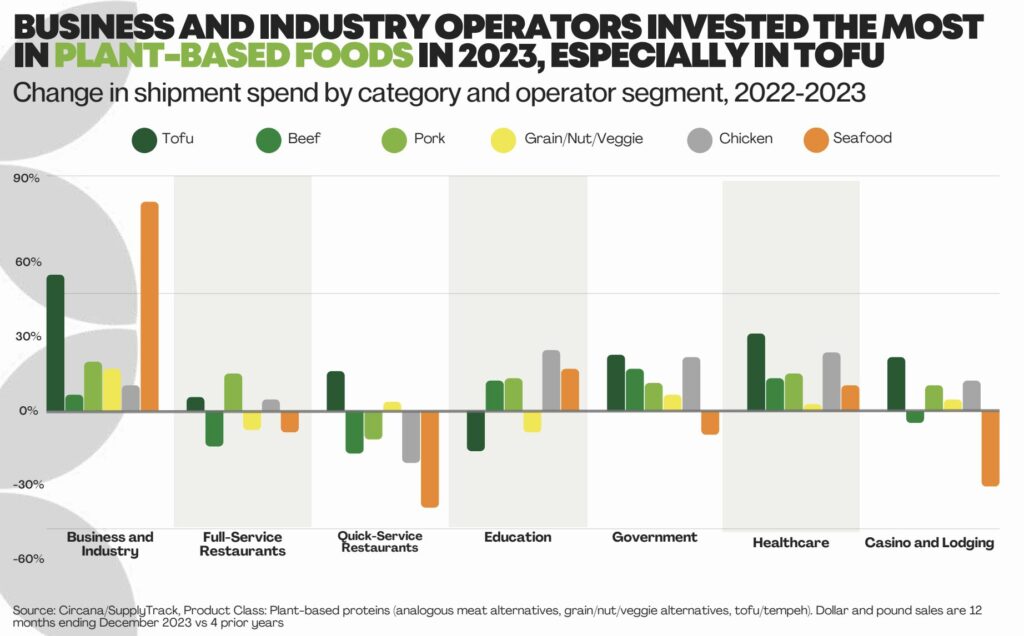

The business, industry, government, healthcare, casino and lodging sectors all invested the most in plant-based foods, especially tofu, representing the growing focus on whole foods.

“We do think, however, that the products that emulate the big ‘ordinary’ protein movers – beef, chicken, pork, seafood – are the most important to the non-commercial space,” said Morasco. “We sell a lot of hamburgers and chicken tenders and need plant-based alternatives to those that taste like the ordinary version.”

But for restaurants, plant-based meat, egg and cheese analogues present a major opportunity. An analysis of 20 eateries over six months found that introducing these options increased the total sales of all plant-based orders by 112% and mixed orders by 35%.

First-time guests placing vegan orders were twice more likely to return for a second visit than those who ordered animal-based foods. Moreover, plant-based orders boosted check averages by 8% (versus 1% for animal-based orders), indicating that higher-quality offerings justify the premiums on plant-based food.