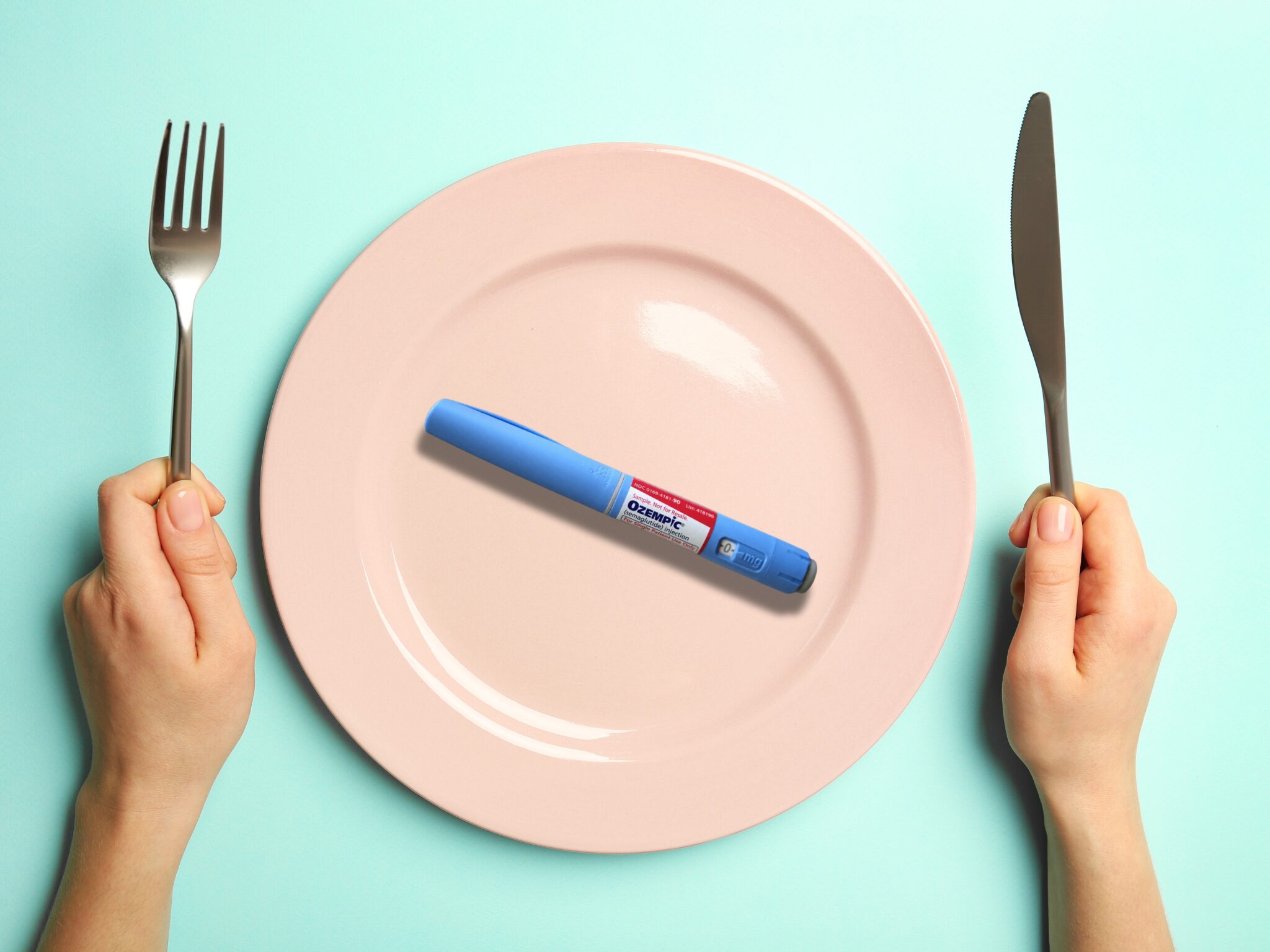

5 Ways Weight-Loss Drugs Like Ozempic & Wegovy Will Change the Food Industry

6 Mins Read

Semaglutide drugs like Ozempic and Wegovy are making headlines daily as more and more people get prescriptions; here’s how these drugs like Ozempic and Wegovy could change the food industry.

With a third of Americans clinically obese, it’s no surprise that once semaglutide drugs entered the mainstream conversation – they are mostly prescribed for type 2 diabetics – they took off. The likes of Wegovy, Ozempic and Mounjaro use GLP-1 (plus, in the latter’s case, GIP) hormone analogues to promote weight loss and blood glucose control – essentially, they make you lose weight, as a consequence of feeling fuller and eating less.

In 2022, nine million Americans were prescribed Novo Nordiksk’s Ozempic, a number that could rise to 24 million in the next decade, according to a report by Morgan Stanley. When you factor in diabetic and obese patients from around the world, there could eventually be over a hundred million people on these drugs within a decade. And the effects are more than physical. Goldman Sachs analysts predict that semaglutide drugs could boost the US GDP by 1% thanks to the productivity gains of a healthier labour force. This is why, in our 2024 food trends forecast, we predicted that Ozempic could change the food industry as we know it. Here’s how.

1) Big Pharma’s influence on Big Food may grow

Lars Fruergaard Jørgensen, CEO of Ozempic maker Novo, made global headlines earlier this month when he revealed that heads of food companies had been in touch with him for advice. “A couple of CEOs from, say, food companies have been calling me,” he told Bloomberg. “They are scared about it.” Food companies are scrambling as they prepare for a consumer base that ends up looking for healthier food – and less of it.

Big Food is already feeling an effect. Walmart has already seen a fall in unit sales, as Ozempic-buying shoppers put fewer units and calories into their baskets, while manufacturers like Pepsi, Mondelez International and Kraft Heinz have all seen their stocks fall in the past year. Even Nestlé, in fact, is developing “companion products” packed with vitamins, minerals and supplements.

It’s likely Fruergaard Jørgensen and his counterparts at other drug companies now manufacturing their own versions of semaglutide, such as US-based Eli Lilly, will be fielding calls for a while.

2) Beverage companies could face challenges

Speaking of drinks, Ozempic could spell trouble for the beverage industry. One survey has shown that almost a quarter of people are drinking less coffee as a result of using semaglutide drugs, while two-thirds have either quit sugary sodas entirely or reduced consumption. And while alcohol spending has decreased in the US, this drop has been more dramatic among households where someone was using GLP-1 drugs for weight loss.

But unlike their food peers, executives of beverage companies remain mostly unconcerned. Nestlé, 7% of whose sales come from coffee, says it has plenty of categories (like pet care) where GLP-1 will have no impact. For Coca-Cola, 65% of its revenue already comes from low- or no-calorie drinks, while Pepsi doesn’t think GLP-1 drugs have slowed demand for its drinks. And alcohol giant AB InBev’s CEO Michel Doukeris has also claimed Ozempic has not impacted the business, despite anecdotal accounts that people taking these drugs tend to have far fewer alcohol cravings.

3) Health-forward food chains could see a revenue boost

The rise in semaglutide use could mean better sales for fast-casual chains and meal services that are centred around health. For example, vegan meal delivery service Daily Harvest has launched a new meal collection specifically for Ozempic and Wegovy users, in partnership with diet company Noom.

Meanwhile, Chipotle has already prophesied that Ozempic users would want its fresh, wholesome foods over junk foods like fries – research has shown people prefer vegetables and fruit when using Ozempic – although a recent survey revealed a dip in footfall from people who start GLP-1 medications. Salad chain Sweetgreen and Mediterranean restaurant group CAVA, however, say they have seen an increase in visits.

4) Fast-food companies will need to rethink their strategy

The above survey showed that burger chains are the hardest hit, with Shake Shack specifically called out for its “lack of history of successfully pivoting to healthier offerings”. But it’s not just foodservice – junk food retailers will need to revamp their approach too, with research showing that nearly a third of American GLP-1 drug users are eating fewer carbs and snacks, 38% are reducing their fat intake, and 45% are consuming less sugar than before.

People taking semaglutide drugs have been found to consume 20% fewer calories on average and be less interested in fatty, oily and fried foods, and a Bloomberg Live Pulse survey showed that fast-food companies will need to tweak their businesses or fall foul of investors. Nearly three-quarters of respondents said companies making sugary, fatty or ultra-processed foods should rethink their plans via smaller portions, newer recipes, or asset elimination, while only a quarter believed these conglomerates could see out the threat posed by these drugs with time.

5) Gut health, fibre-rich and plant-based food companies stand to win out

GLP-1 agonist drugs replicate a natural phenomenon in our bodies- our gut secretes incretin, a hormone that can be regulated with nutrients like dietary fibre and fermented foods, and boosts GLP-1 to control appetite and metabolism. This presents a significant opportunity for fibre-forward food companies like Supergut, Olipop, Pendulum, Uplift Food and Poppi, which are taking on Ozempic and Wegovy through foods and beverages packed with resistant starches and prebiotic fibre.

Plant-based foods, meanwhile, are adept at providing the nutrients needed to support a wider diversity of helpful gut microbes. Larger CPG companies are taking note of this. Take Unilever, which suggests that one of the best ways of maintaining microbiome diversity is to “eat a wide range of fruit and vegetables”, which is why it plans to double the number of products that include meaningful amounts of healthy ingredients such as vegetables and fruits. The goal is to make these products represent 54% of its total portfolio – by 2022, this figure had already reached 48%.

Likewise, Danone – the French dairy giant that owns plant-based dairy brands Alpro, Silk and So Delicious – is being tipped to succeed too, with analysts forecasting that it could double its sales through protein yoghurts and yoghurt drinks if Ozempic users end up going for healthier options. Just earlier this month, for example, it launched a protein-packed Silk Greek yoghurt in Canada, containing 12g of plant protein per 175g pack.