‘The Centre of Challenges & Solutions’: 7 Alt-Protein Takeaways from GFI APAC’s State of the Industry Report 2023

8 Mins Read

The Good Food Institute (GFI) APAC’s first State of the Industry report highlights the funding rollercoaster that is alt-protein, Singapore’s reputation as an innovation launchpad, barriers to the adoption of plant-based meat, and the receptiveness to blended meat products. Plus, a separate report by GFI showcases the potential of sidestream valorisation.

GFI APAC launched its first State of the Industry report last week, showcasing alt-protein’s tremendous potential and heightened challenges in Asia-Pacific. The think tank explores the investment gap in the sector, describes the importance of scaling up and presents a consumer survey showcasing interesting results and opportunities for alt-protein producers, including those working with blended meat.

Here are the key takeaways:

APAC private alt-protein investment reached a high, then fell off a cliff

2022 was a record year for alt-protein financing in the region. Public funding increased by 207% from 2021, from $31M to $94M. This sum was actually 37% higher than the all-time total up to 2021 ($68M). The current total ($162M) accounts for 16% of all alt-protein investments globally.

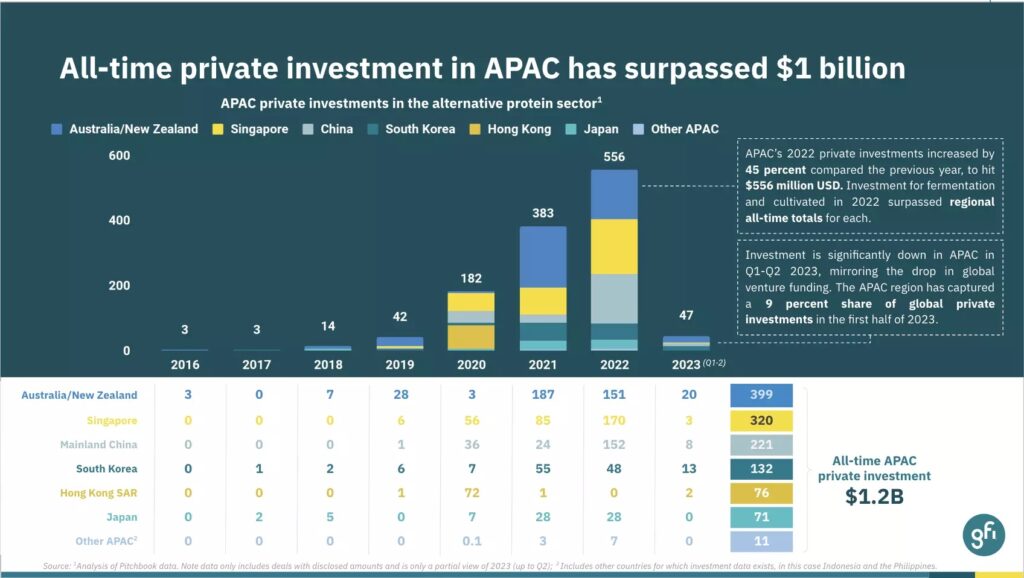

Similarly, at $551M, private financing was up by 45% year-on-year, surpassing $1B in all-time funding. But the sector was also affected by the global downturn in VC funding, which reached a 13-quarter low, with the first half of 2023 only witnessing $47M in investment.

After surpassing Australia/New Zealand in funding last year, Singapore has now given way to the Antipodean nations when it comes to investments in the first half of 2023. Australia and New Zealand garnered $20M in funding, followed by South Korea ($13M), mainland China ($8M) and then Singapore ($3M).

APAC’s business ecosystem is growing rapidly

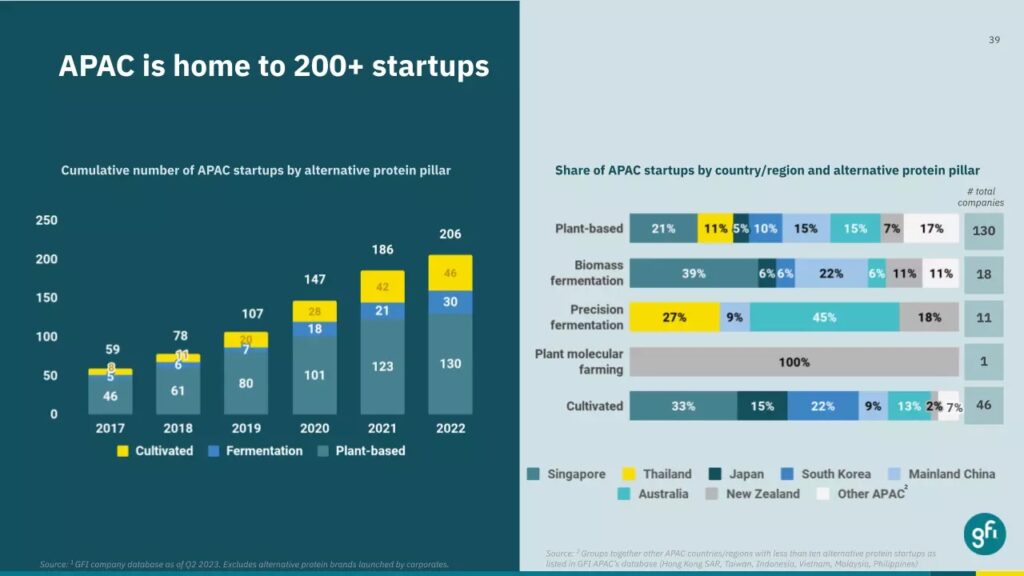

There are now at least 206 startups working with alternative proteins in APAC, with 20 launching just last year. Interestingly, most of these new startups from 2022 are focused on B2B rather than B2C, which is an inversion from earlier years.

Of the 206, 130 companies belong to the plant-based pillar, 46 in the cultivated meat space, and 30 in fermentation. Australia (45%) leads the region in terms of precision fermentation startups – like Eden Brew, Cauldron and All G Foods – followed by Thailand (27%). Singapore, meanwhile, is home to the highest number of biomass fermentation (39%), cultivated (33%) and plant-based (21%) startups in APAC.

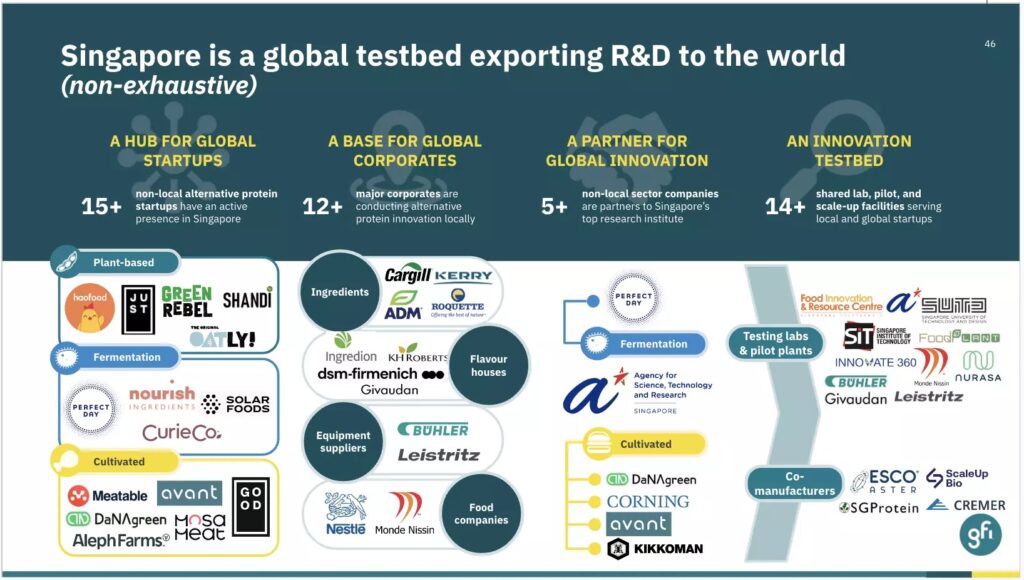

Singapore is a testbed for R&D exports

Despite the decline in private funding, Singapore remains a “global testbed” for the region, helping producers incubate, innovate, partner, and export their alt-protein offerings internationally. At least 25 non-local companies have a presence in the island state for R&D and business development, while it’s home to almost a quarter (24%) of all alt-protein startups in APAC.

Shared R&D facilities and progressive regulatory frameworks are enabling companies to scale up their products and conduct market tests. The country was the first in the world to approve the sale of cultivated meat, and these feats are why its trade minister Alvin Tan dubbed it “the best place in the world for food innovation”.

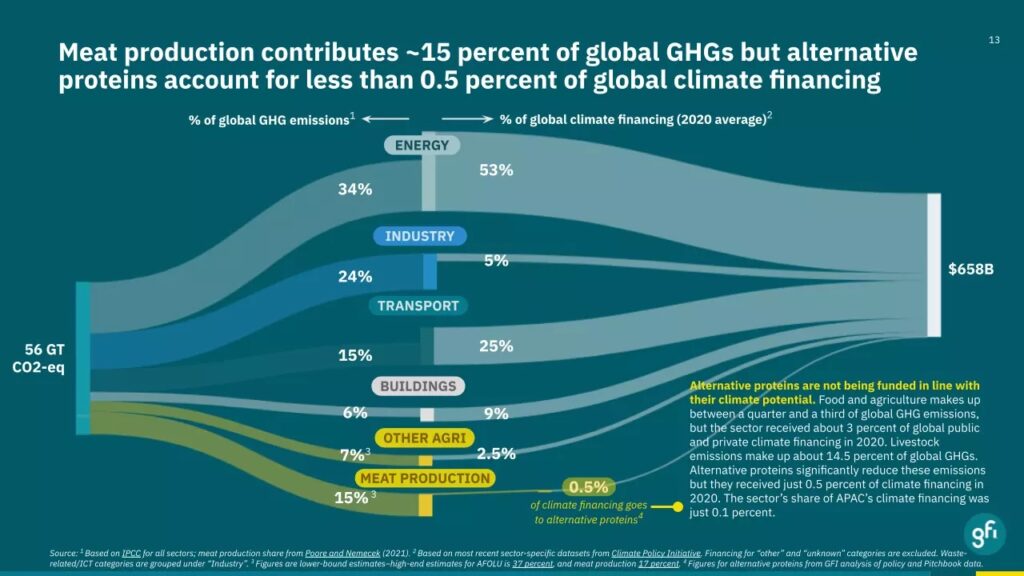

Alt-protein needs $10B of investment – per year

Despite the record public funding numbers, alt-protein’s share of funding is minuscule when looking at it more closely. GFI APAC cited data from the Climate Policy Initiative from 2022, which revealed that only about 3% of all climate finance goes to agrifood systems (that has minutely risen to 4.3% this year).

According to GFI APAC, alt-protein only represents 0.5% of that share (with APAC making up 0.1%), despite these foods significantly reducing the impact of food on the environment, which accounts for a third of all emissions. For example, a study earlier this year found that veganism can cut emissions, land use and water pollution by 75% compared to meat-rich diets.

The report estimates that if funding for alt-protein could capture just 8% of the global meat market by 2030, the reduction in GHG emissions would be equivalent to decarbonising 95% of the aviation sector, adding that “unlocking the full benefits” of alternative proteins will require about $10.1B in public funding annually.

Overcoming scale-up challenges is key

The report states that there’s an urgent need to address the alt-proteins scale-up barriers, which is key to achieving mass production and price parity with conventional proteins: “Building factories cheaply and proving demand in early markets will help to make scale-up more affordable, easier to finance, and lower risk.”

Co-manufacturing organisations can further support efficient scaling-up, and Singapore has established the platform for derisking early scale-ups, with companies like Esco Aster and SGProtein leading the way. And while first-movers are exploring the scaling advantages of other APAC countries for later-stage co-manufacturing, there are significant gaps in the region’s scaling capacity. The report says that considerably more alt-protein tech facilities are needed across scales, especially demonstration, first-of-a-kind, and commercially proven plants.

Consumers want to try more plant-based meat, but barriers keep them at bay

The report also published results of a six-country, 5,971-person survey about plant-based meat, dividing participants into sceptics, rejectors, novices, curious, expanders and enthusiasts based on their responses. Thailand seems to be the most receptive to plant-based meat, while Singapore surprisingly has the highest number of sceptics (unlikely to try) and rejectors (who want to lower their alt-meat intake).

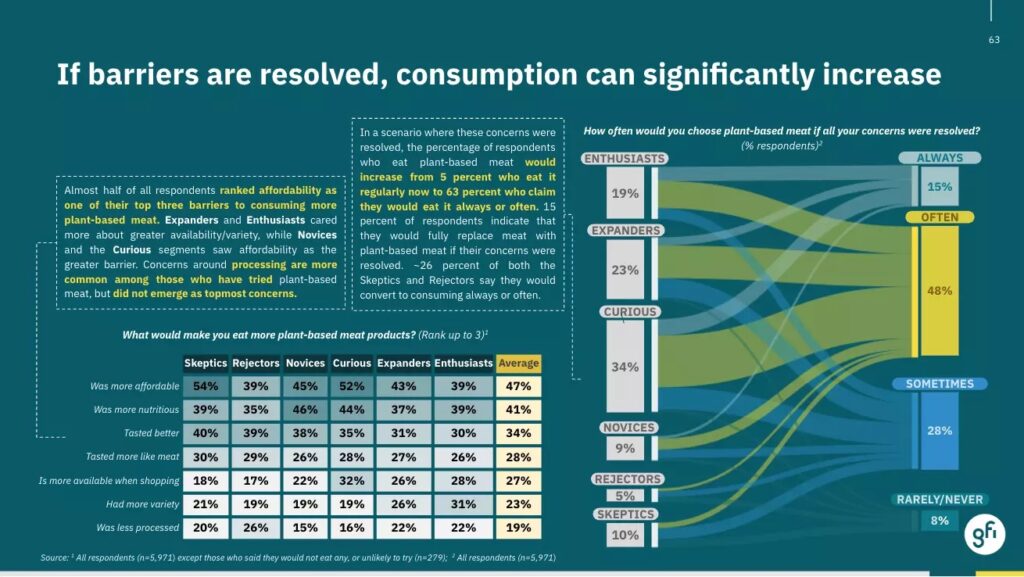

Like the US and Europe, health is the biggest driver of plant-based meat intake for Asian consumers too, followed by taste and affordability. But when it comes to barriers of consumption, this is flipped, as price takes top priority, followed by nutrition and flavour.

If they were more affordable, nutritious and better-tasting, it would increase the number of APAC consumers who eat meat alternatives from 5% to 63%. And 15% of these respondents say they would fully replace conventional meat with plant-based if their concerns are alleviated – highlighting a massive growth opportunity for brands in this space.

Flexitarians are also key for these companies. Plant-based sceptics and novices are also the groups that consume meat the lowest, while meat intake is trending up for enthusiasts, who are the current buyers and represent higher-income consumers. This means that the people who eat the most plant-based meat also consume conventional meat more often than the rest.

Blended meat is of high interest – especially to vegan sceptics

Blended meat products – which combine plant-based ingredients and proteins with animal-derived meat – are on the up right now. A majority of consumers (93%) showed at least some interest in these foods, with over half saying they’re very interested.

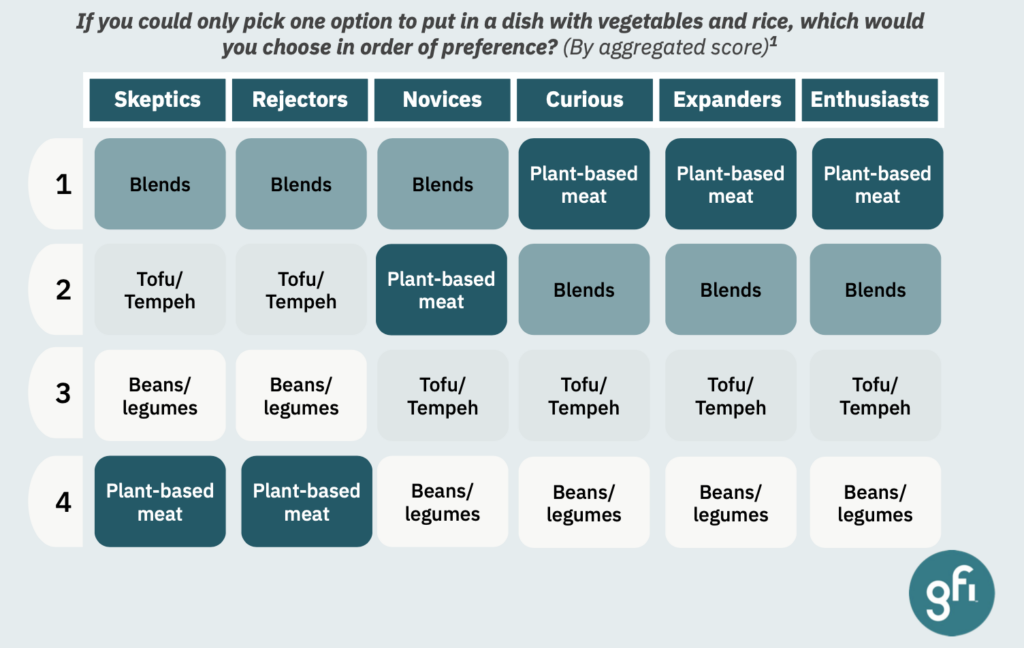

Notably, almost two-thirds of sceptics and rejectors showed some interest in blended meat, with nearly a fifth of the latter very interested. Enthusiasts were the most interested, reflecting their wishes for diverse protein options.

When presented with an option to choose from tofu/tempeh, beans/legumes, plant-based meat and blended meat, the groups that eat vegan meat alternatives the least – sceptics, rejectors and novices – placed blended meat on top, while the former two put plant-based at the bottom. For the rest, plant-based meat leads the way, but blended meat comes second.

This reflects the potential of blended meat to flip the perception of consumers apprehensive of plant-based meat, and help them move towards lower meat consumption.

Sidestream valorisation could advance alt-protein

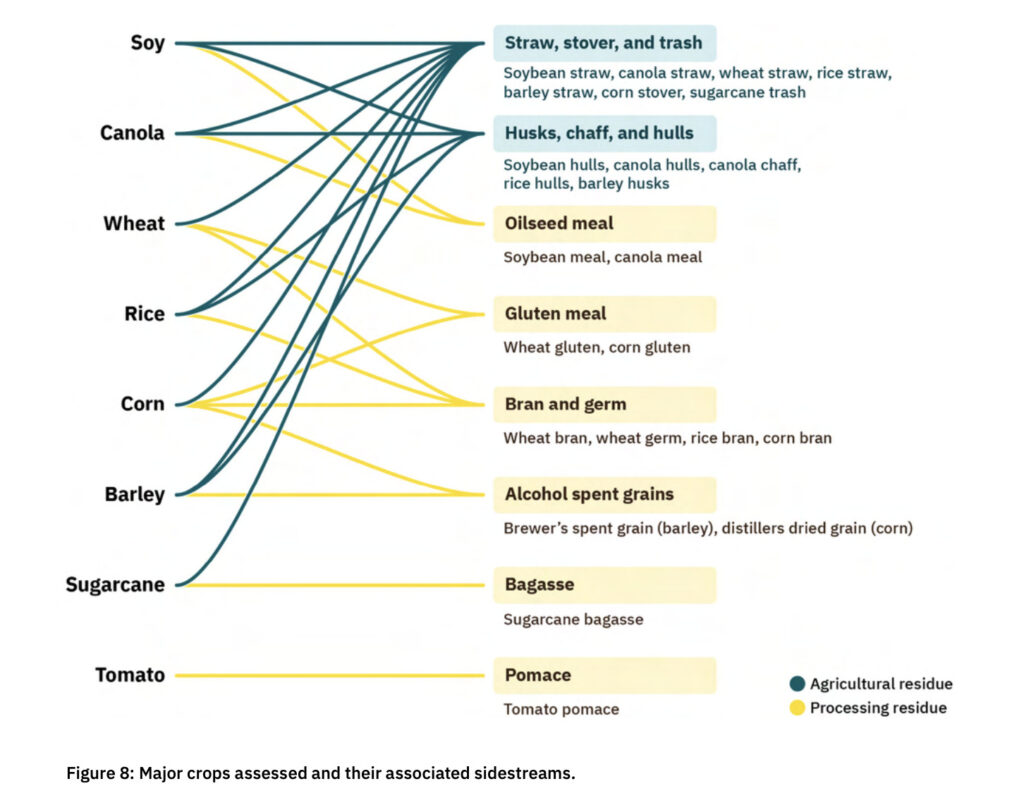

In a separate report by GFI’s US division, the think tank analysed eight high-volume crop sidestreams in the US, Canada and Mexico to determine which has the highest potential for plant-based, fermented and cultivated protein ingredients.

Soy meal (commonly used as animal feed), tomato pomace and canola meal were ranked as the crops most ideal for sidestream valorisation to make protein concentrates for plant-based products. Soy meal also ranked as the top crop to upcycle for protein hydrolysates for fermentation and cultured meat media – developing this sidestream could help tackle the cost and scale-up challenges mentioned above.

For fermentation-based proteins – specifically lignocellulosic-derived sugars – corn stover was earmarked as the most useful sidestream, followed by soy straw, rice hulls and sugarcane trash. All these crops were measured against criteria like production volume and cost, environmental credentials, and functional attributes.

“We currently produce significant amounts of waste due to low-value utilisation and disposal of things like agricultural residues, processing side chains and food losses generated throughout the supply chain,” said Lucas Eastham, a senior fermentation scientist at GFI. “The valorisation or the upcycling of agricultural and processing side streams presents an opportunity for us to shape the circular bioeconomy, and this will help us reduce waste and increase food production.”

TLDR: to reach its full potential in APAC, alt-protein needs significantly higher public and private investment, better taste, nutrition and prices, more facilities to derisk scaling up, and higher sidestream valorisation.

Read the full GFI APAC State of the Industry 2023 report here.