Plant-Based Meats Grow by 14% in Australian Retail, with Burgers Making Way for Deli Meats & Ready Meals

6 Mins Read

Despite facing a tough time globally, Australia’s plant-based meat sector has proliferated in the last few years, with the number of products on sale in retail channels growing by 14% from 2022-23, according to alternative protein think tank Food Frontier.

Out with the burgers, in with the deli meats. That’s the way Australia’s plant-based meat sector has gone over the last few years, according to research by Food Frontier, which found that between September 2022 and 2023, the number of meat analogues on sale down under increased by 13.7%.

Ahead of the release of its third State of the Industry report in mid-2024, the think tank has released its analysis of audit results of major supermarkets in Melbourne and Sydney in mid-2023, revealing that the volume and types of plant-based meats have changed significantly over the last three years.

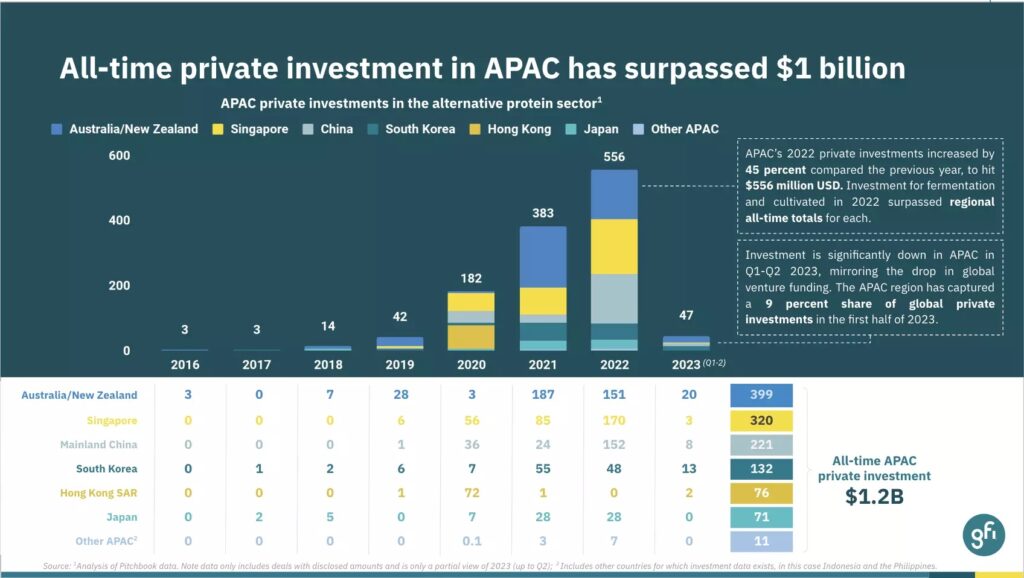

With Australia and New Zealand leading Asia’s alternative protein investments last year, garnering $20M in funding in the first half of 2023, the former country has bucked the global retail trend for plant-based meats, with a threefold increase in on-shelf products over the last few years, from less than 90 to just under 300.

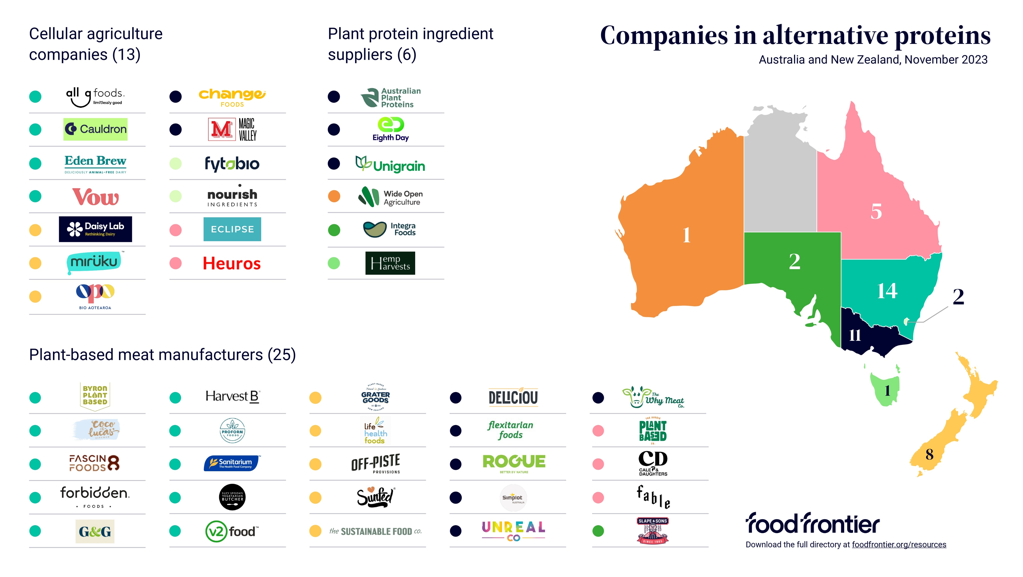

Where companies like Beyond Meat and Quorn have struggled overseas, brands like Heck have reduced their plant-based offerings, and labels like Nestlé’s Garden Gourmet have withdrawn from certain markets, the plant-based meat category in Australia has gone from fewer than five Antipodean brands in 2017 to more than 30 in 2023.

Food Frontier’s 2020 State of the Industry report revealed that plant-based meats alone could generate nearly AU$3B in sales and provide 6,000 full-time jobs by 2030.

Convenience takes over utility for Australia’s plant-based meat sector

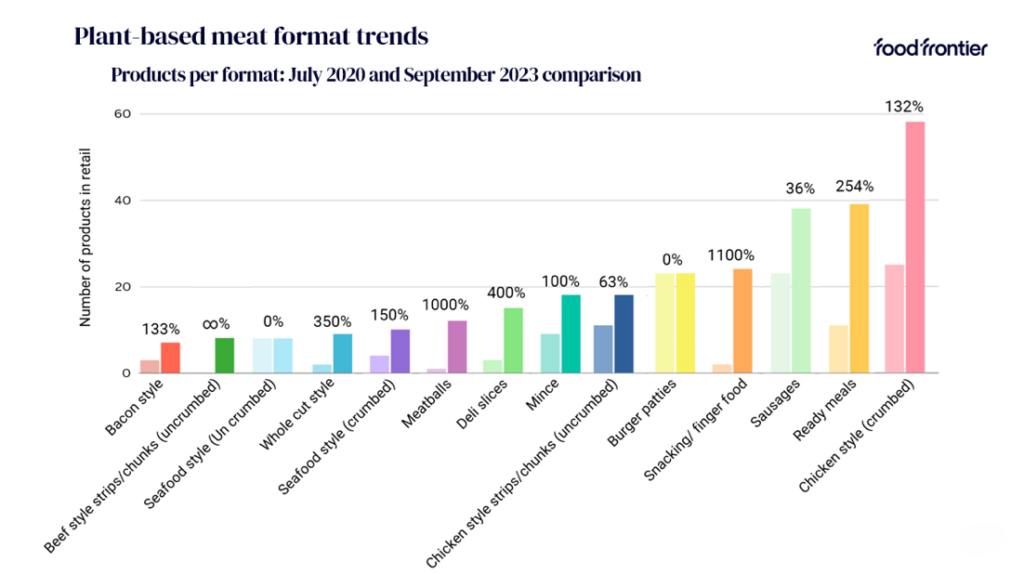

Food Frontier’s analysis reveals a shift in product categories as well. While burgers and sausages were all the rage a few years ago, the growing need for convenience has seen formats like snacking and finger foods, deli slices and ready meals come to the fore.

Versatile, functional products that can be integrated into multiple dishes – beef strips and chunks, and whole-cut meats – have proliferated, although there are still fewer than 10 products of each format in the retail market. Between July 2020 and September 2023, the number of burger and uncrumbed seafood analogues has remained the same, while sausage products have just witnessed a 36% increase.

However, there are 132% products in the crumbed chicken pieces category (nearing nearly 60 on-shelf offerings), with even greater increases for ready meals (254%), whole cuts (350%), deli slices (400%), meatballs (1,000%), and snacking and finger foods (1,100%).

“The market has seen a growth in interest in products presenting more options and greater versatility than the traditional utility products such as burgers and sausages,” Food Frontier CEO Simon Eassom told Green Queen. “Manufacturers have moved to meet the consumer with an increase in chicken-style products both as ready-to-use finished products, but also for inclusion in their cooking (for example, chicken-style strips and chunks), as well as in chicken-based ready meals.”

Asked whether he expected this shift in format popularities, he said: “We weren’t surprised to see the evolution from burgers and sausages to formats that are more flexible and adaptable to different cuisines. This again reflects a maturing of a market in which consumers are expecting more. The increased provision of deli meats has been interesting to observe, as well as the growth in utilisation of plant-based meats into convenient ready-meal formats.”

The report suggests that the number of meat alternatives in Australia peaked at about 350 in early 2023, which was followed by consolidation in a few categories. Eassom explained that when these products first appeared on retail shelves, they were utility foods, but with too many manufacturers of the same products, Australians have “voted with their tastebuds and their wallets”.

Local companies dominate the alt-meat market down under

The data indicates that formats beyond burgers and sausages that can be incorporated into a much wider range of dishes are gaining favour, and manufacturers are responding accordingly. “We know that the early adopters of plant-based meats in Australia and around the world are flexitarians – they are the cohort, used to centre-of-plate proteins or protein-based dishes, that are now looking for healthier alternatives to those conventional protein sources and for products that mimic what they’re used to buying,” said Eassom.

A November 2022 YouGov Australia poll revealed that 19% of respondents called themselves flexitarians, while a further 9% were vegan, vegetarian or pescetarian. Taste and health were the top priorities for flexitarians, indicating the challenges for plant-based food manufacturers. Meanwhile, a study from Queensland’s Griffith University in October found that nearly a third (32.2%) of Australians have reduced their meat consumption over the last year, with 71.3% eating either completely meatless diets, mostly plant-based, or having some plant-based dishes in an overall omnivorous diet.

Food Frontier also found that the lion’s share of the market is now dominated by a few strong brands. And there has been a marked rise in homegrown brands too. With at least 31 plant-based meat manufacturers and ingredient suppliers in Australia – including v2food, The Aussie Plant Based Co and Fable Foods – the companies now make up 56% of plant-based products in major retail in Australia – up from less than half in 2019. International manufacturers like Beyond Meat, Impossible Foods and Fry Family Food are "holding their own" too.

"A number of factors have affected the decline of international brand products in relation to the growth of Australian manufactured products," Eassom told this publication. "First and foremost, the products from the big, well-known US brands have always been viewed as premium products with a price tag that has been difficult for consumers to meet under recent financial conditions. The relatively weak Aussie dollar has not helped.

"In addition, several major international food manufacturers have withdrawn their early plant-based meat offerings or are reviewing their strategy within the sector. At the same time, a handful of Australian brands have seized the opportunity to consolidate their position in the market and take advantage of the rise in demand for new formats, such as crumbed chicken-style products.

"v2food has been extremely successful in its brand positioning within the retail sector as retail buyers have sought to consolidate their relationships around suppliers that can provide the whole range of products; i.e., beef-style as well as chicken-style across a multitude of formats from mince to schnitzels."

Food Frontier expects the category to keep evolving, with changes in company integration and product formulations not out of the question. “This is a food industry that’s continuing to innovate and adapt to consumer tastes and budgets," said Eassom. "The availability of more sophisticated ingredients will help manufacturers improve products to meet expectations around taste and texture, as well as price."