Exclusive: Lupreme Maker Eighth Day Foods Puts Tech & Business Up for Sale

6 Mins Read

Australian food tech company Eighth Day Foods is in the process of finding buyers for its fermentation technology and the business itself, with the aim to focus on scaling up as part of a mature multinational company.

Eighth Day Foods, the company known for its Lupreme protein for plant-based applications, is up for sale, having been in talks with buyers for the last three months. The startup decided to sell its proprietary fermentation tech amid a tough funding landscape, and believes it can double down on its commercialisation efforts as part of a larger, more established parent company.

“Investment for scaling production has proven challenging for most start-up businesses right now, especially in the alternative protein sector,” CEO Tony Cartwright told Green Queen. “We believe the best strategy, therefore, is to place our technology in the hands of a mature company with extensive multinational reach and a vision for global impact.”

Alternative protein financing dipped by 44% in 2023, mirroring the 42% drop in overall VC funding. Startups working in fermentation-derived proteins felt these effects too, with investment declining by 39% from 2022-23. The dire VC landscape brought about a volatile environment for food tech startups, with many plant-based companies losing sales and several downsizing or shutting down.

“Our business is focused on running a lean operation, especially on costs to maintain a low-cost base to keep us cashflow-positive. This focus kept our internal headcount to a minimum,” explained Cartwright, noting that the company only has two other employees (co-founders Jen and Roger Drew). He added that they are “fully committed to supporting a new ownership if necessary”.

Rapid solid-state fermentation makes better and cheaper products

Eighth Day Foods’ USP is its mycelium fermentation technology, which is an extension of traditional solid-state fermentation. This is primarily used for biomass applications and involves growing microbes atop an inoculated solid surface, with the initial feedstock retained in the final product. “This is the most efficient and environmentally sustainable way to transit nutrition from the paddock to the plate,” claims Cartwright.

The startup’s rapid solid-state fermentation (RSSF) process takes things up a notch, altering the three elements of this type of fermentation – the separation of the initial seeds, the hydrothermal process, and the fermentation – and then applies a fourth step post-fermentation, which transforms the mycelium into a highly functional structural component ideal for whole cuts of meat and seafood analogues.

Expanding on the ‘rapid’ side of things, Cartwright explains that the production time is only 50-60% that of traditional solid-state fermentation, and a tiny fraction of the processes being used by others. “This has enabled us to easily scale with an opex and capex at only a fraction of all other alt-proteins,” he said. “We can provide the whole-cut value proposition of high-moisture meat extrusion and the like for a price well below that of simple dry-textured vegetable protein products.”

All foods made using the RSSF tech are functionally and nutritionally enriched by mycelium. “RSSF transforms a loosely woven mycelium structure into a functional binding agent without the need for extra ingredients,” said Cartwright.

It’s also a low-waste process, as Eighth Day Foods uses whole seeds like lupin and navy beans, which eschews the need for processing and additives, and avoids the waste generated by the production of protein isolates or concentrates (thus also saving costs).

The result is a clean-label whole-food, whole-cut meat analogue that enhances the umaminess of beans and seeds, provides textural complexities, and enables a higher bio-availability of essential amino acids. The protein content itself is boosted by the combination of pulses or beans and mycelial proteins.

Eighth Day creates whole-cut whitefish

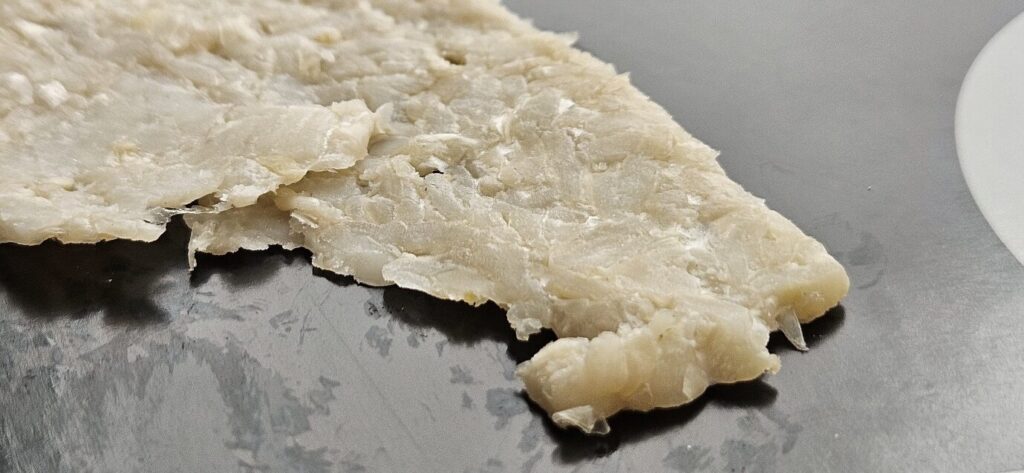

Eighth Day Foods first used this technology to create Lupreme, a lupin-based protein for B2B partners to use in vegan product formulations. Now, it has unveiled the second creation leveraging RSSF, a whole-cut whitefish analogue. The most pressing pain point for this seafood is replicating its trademark flakiness.

While both mycoprotein and traditional TVP methods are suited to make fish alternatives, the startup argues they fall short in delivering that texture. Its RSSF tech, however, enables it to bypass these obstacles and create the flakiness, resistance, bite, pearl-like colour and translucent appearance of whitefish without any artificial whitening – the mycelial crosslinking also helps avoid the overbinding of flakes. Plus, these cuts can caramelise like their conventional counterparts, and be grilled without any additional crumbling or coating.

The fish’s base is made from navy beans, with water, vegetable oil, vinegar, citrus fibre and cultures rounding up the list. “Of all pulses and grains, navy beans uniquely hold the best natural colour and flavour profile for whitefish,” explained Cartwright. “Further, the functional capabilities of navy beans enable whole-cuts that emulate the natural bold flakiness, texture and mouthfeel unique to whitefish.”

He added: “RSSF is capable of a wide range of whitefish-like products, with variability in flake type, flake bonding, oiliness and translucency. It is not limited to a single recipe.” In fact, the applications of RSSF extend far beyond whole cuts of meat and seafood – the tech can also be used to create plant-based dairy, beverages and condiments, low-cost but highly functional emulsifiers, as well as aged care products.

Consolidation not the solution with the current tech

Making itself available for acquisition was a conscious decision made to help realise the true potential of its technology. It will allow Eighth Day Foods to centre its attention on scaling up and commercializing its innovations, with the cushion of a larger company with an international presence – all this will make it easier to fend off “external pressures from traditional meat and dairy industries” and “internal struggles related to pricing, product quality and profitability”, which it says have hindered widespread consumer adoption.

“We are currently working through the sale process and are in discussions with several potential buyers, all of whom have significant NPD teams who can maximise their product offering through our technology,” said Cartwright. “We are making good progress, and we aim to have the sale completed within the next three months.”

Consolidation has been a major theme in the alternative protein industry recently, but, with the current technologies, Cartwright doesn’t believe the trend will help companies overcome the sector’s intrinsic flaws. “The largest players in the industry, with deep pockets (Beyond Meat, Impossible Foods, Quorn, etc.) have already shown that volume alone will not overcome the twin failures of negative margins and misreading the consumers,” he outlined. “Further, consolidating to achieve vertical integration is impossible in an industry so reliant on complex supply chains.

“Until the industry recognises that the existing technologies do not – and probably cannot – achieve sub-meat pricing, clean healthy labels and, importantly, a delicious, truly versatile protein that does not pretend to be meat, it will remain captive to the current downward spiral,” he added. “This is why the technology we chose is so critical, and why RSSF provides the opportunity to achieve all three of these critical benchmarks.”