FoodTech 500: Plant-Based Companies Lead the Way in Forward Fooding’s Annual List of Food Innovators

11 Mins Read

Described as the “Fortune 500 of agrifood tech”, food tech consultancy Forward Fooding has released its 2023 FoodTech 500 list, with the highest number of companies belonging to the plant-based sector. Other alternative protein startups also had strong representation on the list.

US mycelium fermentation startup Nature’s Fynd has topped Forward Fooding’s FoodTech 500 list for 2023, with four other future food companies joining it in the top 10. These include fellow US mycelium protein company Meati, Spanish plant-based meat maker Heura, US molecular farming pioneer Nobell Foods, and German fermentation tech startup Planet A Foods.

The annual list – which began in 2019 – recognises entrepreneurs addressing challenges throughout the food value chain, highlighting the most innovative businesses at the convergence of food, technology and sustainability. This year, over 1,500 companies submitted applications to be featured on the list, representing 34 domains, including plant-based, ag biotech, protein fermentation, cellular agriculture, and vertical and indoor farming.

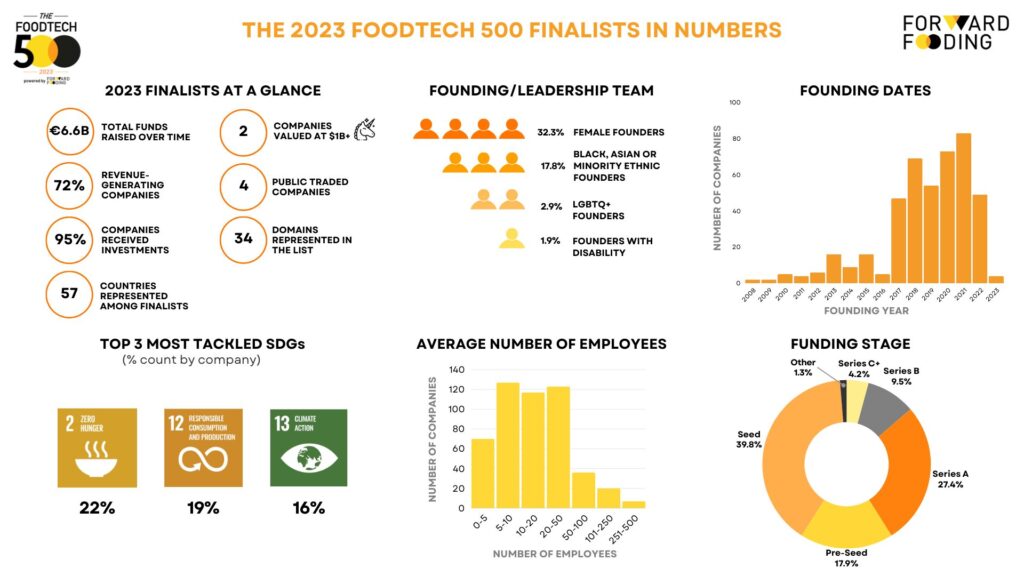

Of the 500 companies selected, nearly a third (32.3%) were female-founded, and just over a sixth (17.8%) had Black, Asian or minority ethnic founders. Meanwhile, 95.4% of the finalists had received investment, with two unicorn companies (having raised over $1B without going public) and four publicly traded businesses.

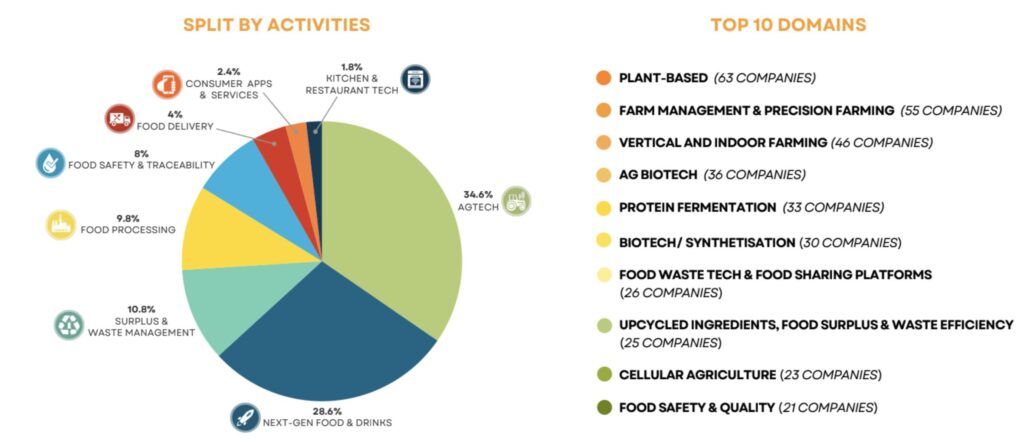

Despite a challenging landscape in terms of both sales and optics, the plant-based industry was the most well-represented domain, with 63 companies (12.6%) appearing on the FoodTech 500 list for 2023. This was followed by farm management and precision farming (55 companies) and vertical and indoor farming (46 companies)

Future food startups innovating with fermentation had a strong presence too, with 33 such businesses on the list, which also had 23 cellular agriculture companies (even without any of their products actually being on the market, which displays their potential).

Alt-protein, agtech and next-gen food companies headline FoodTech 500

The ranking combines scores from three key areas – business size, digital footprint, and sustainability. The sustainability scoring framework was based on selected Sustainable Development Goals (SDGs) from the UN, with SDG 2 (Zero Hunger), SDG 12 (Responsible Consumption and Production), and SDG 13 (Climate Action) being the most addressed.

The business size score predicts growth based on financial indicators like the number of employees, funding stage, total funds raised and number of offices, while the digital footprint ranking forecasts digital presence growth based on website traffic, social media performance and follower growth.

The companies are divided into eight macro activities: Agtech, Next-Generation Food and Drinks, Food Processing, Food Delivery, Kitchen and Restaurant Tech, Consumer Apps and Services, Food Safety and Traceability, Surplus and Waste Management. Agtech dominates the rankings, with over a third (34.6%) of companies on the FoodTech 500 list involved in this space. This is followed closely by Next-Gen Food and Drinks, making up 28.6% of the rankings.

It’s the latter category that houses the five alternative protein companies mentioned above, with Nature’s Fynd – a Bill Gates-backed startup that makes breakfast patties, cream cheeses and yoghurts using its Fy protein – leading the overall list and Heura the highest-ranking plant-based startup (at 7th). The only other alternative protein company to surpass Heura is Meati (6th), which uses mycelium to make whole-cut chicken and beef analogues.

Other companies in the future food sector that make up the top 50 include InnovoPro, Algama Foods, The Seaweed Company, BlueNalu, Koa, Arbiom, Biomilq and Voyage Foods.

“Embracing alternative protein technologies (plant-based, cell-cultured, molecularly farmed, and fermentation-derived) is crucial for food security. These can complement culinary tradition while introducing exciting new options for consumers,” said Christian Pichler, managing director of Gerber VC. “But caution is warranted against misinformation spread by traditional lobby groups with vested interests and significant PR resources.”

Forward Fooding has embarked on a global tour to celebrate the release of the list, starting with London and San Francisco in March, Stockholm (April 9), Berlin (May), Barcelona (June), and Dubai (September).

We spoke to Max Leveau, co-founder and chief operating officer of Forward Fooding, about the 2023 FoodTech 500 list, the plant-based dominance, the biggest surprises, and the importance of female leadership.

This interview has been edited for clarity and concision.

Green Queen: Despite the sales declines and often negative narrative around veganism, why do you think plant-based was the biggest category?

Max Leveau: This year’s FT500 accounts for 63 Plant-based companies, which represents 13% of total companies and the most represented domain within our taxonomy. Our proprietary data tells us that, despite the global VC turmoil, there are over 970 plant-based companies currently operating in the global marketplace. Although 47 shut down over the last couple of years, we still see there is strong demand and new companies keep emerging.

Yet, for the first time, in 2021, more capital was cumulatively invested in fermentation and cellular agriculture than plant-based companies. This marked the beginning of a major shift in the alternative proteins sector.

GQ: Which plant-based, fermentation, and cell ag companies stood out to you the most, and why?

ML: Over the past couple of years, we have witnessed two major ‘forces’ driving the alternative protein sector: increased consolidations and pressing scepticism, mostly driven by media, around companies’ ability to scale up production and overcome regulation hurdles (for example, cultivated meat) and, most of all, to create great-tasting products that will determine consumers’ mass adoption in the long haul. Even though investments in alternative proteins have dropped by 62% since 2021, the sector has reached a tipping point. Despite the negative investment trend, we believe that the current ‘crisis’ will help this industry in the long term.

These factors are forcing entrepreneurs and investors to focus on turning existing companies with strong fundamentals into profitable businesses while forcing smaller and less resilient companies to get consolidated or phased out. For example, we expect to see more ‘hybridisation‘ in product development. This involves creatively combining protein sources and processes (such as plant-based proteins with fermented or cultivated fats). By blending ingredients and technologies, companies can address key product experience elements. These include taste, texture, and nutritional value, but also scalability – think mycelium for umami flavouring of plant-based meat products, serum-free growth media for cultivated meat, companies focusing on cell cultures, etc. Companies such as Mycorena, The Seaweed Company or Multus Bio come to mind.

Moreover, corporate investments and strategic partnerships with startups are expected to play a crucial role in overcoming supply chain challenges. Recent examples are strong signals that the industry is moving in this direction (for example, Cargill’s collaboration with ENOUGH, Kraft Heinz and NotCo’s ongoing partnership or Remilk’s deal with General Mills).

Finally, despite reluctance from certain countries (like Italy and France), we do expect cellular agriculture to become regulated by more countries in the next couple of years. Recent approvals from the FDA – and investments from various governments (such as the UK, Canada and the Netherlands) to support the research and growth of the sector, alongside precision fermentation – are paving the way towards more regulatory approvals in the near term.

GQ: Most of the companies on the list have only been founded in the last five to six years. What does it say about the industry?

ML: It tells us three things. As with any tech sector, when a new technology solution is on the path to becoming mature, more ventures get created because the barriers to entry are relatively low.

More entrepreneurs are building ‘enabling solutions’, such as ‘software for vertical farms’ or growth media for cultivated meat/fish for existing industries (like vertical farming or cellular agriculture).

This is also a reflection of how the global agrifood tech investment landscape has evolved in the past two years:

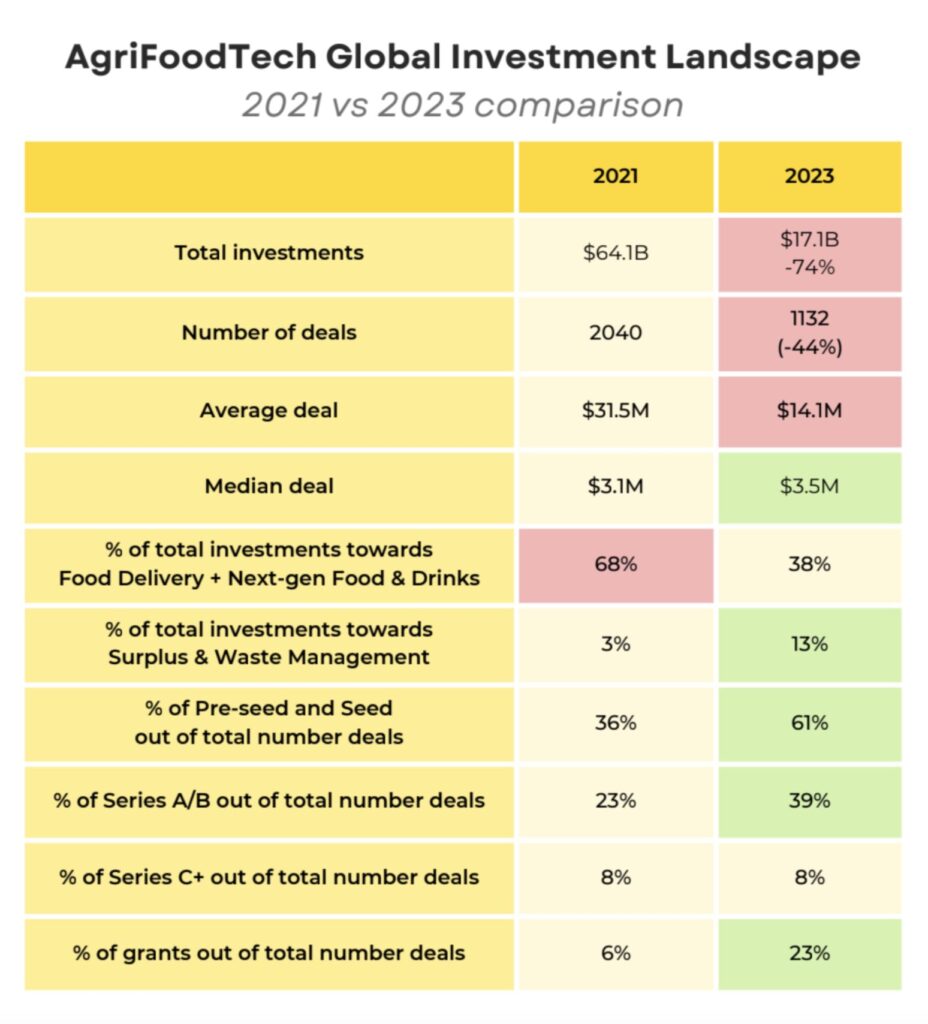

Global Venture Capital is going through difficult times, with AgriFoodTech being no exception to the rule. Since its peak year in 2021, investments in the sector have dropped by 74% to reach $17.1.B in 2023. Many companies have had to shut down operations in the past year. Yet, making a comparison between 2021 and 2023 makes us understand how the investment landscape has been shifting, and we believe there is room for optimism.

First of all, not only has the number of deals (-44% from 2021 to 2023) not dropped as much as the capital invested (-74%), but the median deal has actually increased since 2021. Mega-deals have vanished (the average deal size fell from $31.5M to $14.1M), and generalist investors are leaving the space, while specialist and impact-focused ones tend to go ‘beyond the hype’ to invest in a broader range of solutions across the supply chain (such as technologies to fight food waste). This translates into a new distribution of investments, previously dominated by food delivery and alternative proteins (part of our Next-Gen vertical), as well as a growing proportion of early-stage investments towards less mature or ‘hyped’, but nonetheless impactful, solutions.

New regional dynamics are also emerging. From 23% in 2021, 36% of total investments in the sector went to European companies in 2023. Europe is becoming a true hotbed for agrifood tech innovation, while Asia-Pacific has seen a drop from 11% to 1% (mostly due to a decline in China). And finally, North America continues to lead the sector, gathering 48% of global investments in 2023.

Overall, it is safe to say that capital is no longer a ‘commodity’. Entrepreneurs have to focus on building ‘healthier’ businesses with a clear path to profitability, and ideally ‘asset-light’ models. They also seem to be able to rely more and more on public funding to support their growth, as shown by the sharp increase in the number of grants allocated to agrifood tech startups (up from 6% to 23%).

More patience and smart capital will be needed to solve the challenges of our food system. Looking at the latest investment figures, this seems to be going in the right direction at the moment.

GQ: Which domain were you most surprised by?

ML: Beyond alternative proteins, there are a few domains that are standing out.

First of all, we are quite amazed to see how ag biotech is currently growing. From 17 companies in 2022, it has almost doubled this year with 36 companies within the finalists, as the topics of soil health and microbiome, and seed genetics-focused technologies like molecular farming are gaining more traction. 2023 finalist companies include the likes of Tropic, Soilsteam and Mozza Foods.

Looking at global investments, the surplus and waste management activity went from representing 3% of global investments in 2021 to 13% in 2023. This is well represented in the FoodTech 500 with food waste tech and food sharing platforms (26 companies), and upcycled ingredients, food surplus and waste efficiency (25 companies), with players such as Winnow, Spoiler Alert, Fazla and Peelpioneers.

Finally, it’s quite impressive to see how resilient the farm management and precision farming domain has been year after year, with the growing impact of remote sensing and AI, and led by companies like CropX, Agrivi and Cropin.

GQ: Do you think there’s still some way to go in terms of female leadership in food tech?

ML: Yes, definitely. However, we think the agrifood tech space is intrinsically more diverse than other tech industries. As a matter of fact, over the years, we’ve been reporting that the food tech space is rather diverse, and when using FoodTech 500 as a proxy of the overall space, we have witnessed an increase year-on-year of female-founded businesses among FoodTech 500 alumni. On average, we went from 25% in 2020 to 32% in 2023.

GQ: Where is the food tech sector lacking, and what are its biggest challenges going into the rest of 2024?

ML: With more transparency and self-discipline from founders, combined with more thorough due diligence from investors, we think the agrifood tech industry can capitalise on the growing interest in leveraging technology to improve our food and agriculture system to make it more resilient and sustainable for both people and our planet.

As the market is correcting and science is advancing in the right direction, we believe 2024 could be a vintage year to invest in agrifood tech. Valuations are becoming more ‘sensitive’, and entrepreneurs do have to present a clear and solid path to profitability to be in a position to raise capital.

There’s a need for patient capital too. As AgriFood is one of the most slow-moving/resistant industries to change and technology adoption, we think most investors underestimate the pace at which new solutions can be brought to the mass market. A clear example of this is the plant-based category, which has been around for almost a century now through niche products (mostly vegetarian and vegan options), and only in the last decade has started to really get a growing interest as diets are shifting towards more plant-based. Despite all of this, in the US alone – the most mature market for plant-based meat 2.0 – sales reached only 1% of total meat sales in 2022.

Another example is the vertical farming sector currently going through a ‘disillusion phase’, after a few companies went through bankruptcy, despite having raised hundreds of millions in capital. This was mostly due to a misalignment between investors’ expectations, the readiness of the technology, and the validity of the business model of some companies.

With generalist investors leaving the space, and more and more ‘educated’ agrifood-tech-focused funds emerging, we expect to see a big change in that regard. Additionally, the speed of evolution for novel foods and alternative protein regulation around the world will have a key role to play.

GQ: What is your hope for the companies who have made it onto the list?

ML: That they will keep focusing on building ‘cash-positive businesses’ capable of generating real impact at a food system level. They will be able to adapt their business financing needs, as global markets may remain very difficult in the coming years as far as funding is concerned. And they’ll keep focusing on impact and mission-driven businesses that can prove to be a force of good in making our food system more sustainable and resilient.

Check out Forward Fooding’s full 2023 FoodTech 500 list here.