How Can Investors Engage the Fossil Fuel Companies ‘Way Off Track’ from Paris Agreement Goals?

5 Mins Read

Despite making big climate pledges, the world’s largest oil and gas companies are “way off track” from reducing any emissions, with plans to instead increase production. Here’s what investors need to consider.

In Dubai last year, leaders from across the world came together to figure out what to do with fossil fuels. Despite hopes for a full phaseout, the infighting between stakeholders became so intense that COP28 went into a reserve day to come to a resolution. In the end, countries agreed to a transition away from fossil fuels, but there was no phaseout mentioned in the final text of the conference.

Now, a comprehensive assessment by climate think tank Carbon Tracker has revealed that none of the production and transition plans for the world’s 25 largest fossil fuel companies align with the temperature goals agreed at the 2015 UN climate conference in Paris.

“Companies worldwide are publicly stating they are supportive of the goals of the Paris Agreement, and claim to be part of the solution in accelerating the energy transition,” said report author and oil and gas analyst Maeve O’Connor. “Unfortunately, however, we see that none are currently aligned with the goals of the Paris Agreement, albeit there are clear differences between companies. This report gives evidence for investors and other stakeholders to hold companies to account.”

Almost all fossil fuel companies aim to expand production

Titled Paris Maligned II, the report builds on Carbon Tracker’s previous research into fossil fuel companies’ efforts to adapt to climate change and the energy transition. It assessed the compatibility of the upstream portfolios of these firms in a moderate transition scenario (limiting temperature rises to 1.7°C above pre-industrial levels), as well as considering 1.5°C alignment.

It found that companies are still sanctioning new projects that are incompatible with the Paris Agreement. For example, TotalEnergies and CNOOC’s expansion in Uganda has seen six new projects sanctioned, and three of these aren’t even compatible with a slow transition (2.4°C). If completed, Chevron’s Aphrodite gas field and TotalEnergies’ offshore Cameia project are also projects that won’t be compatible with 2.4°C.

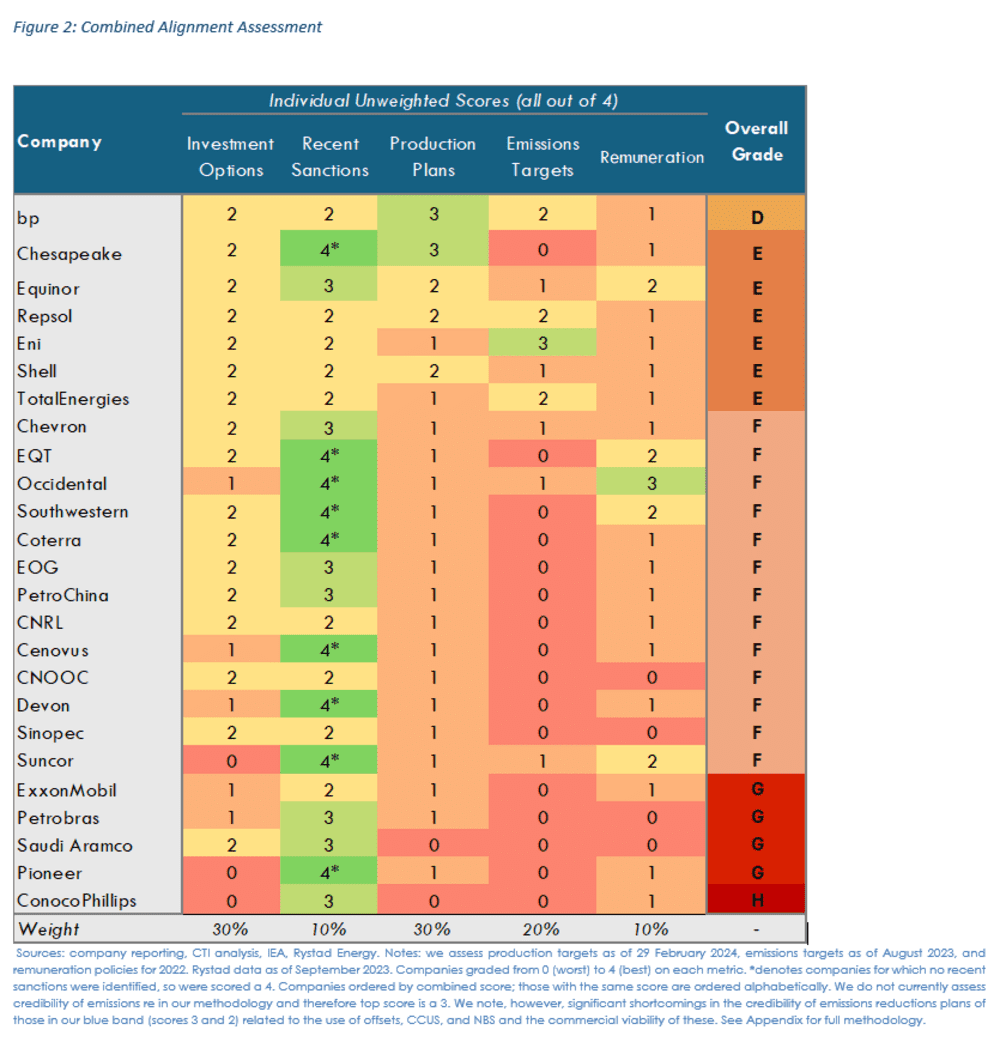

Carbon Tracker took these assessments and measured them alongside other key metrics – namely Investment Options, Recent Project Sanctions, Production Plans, Emission Targets, and Executive Remuneration – with companies being scored on a scale of 0 to 4 for each category, and graded from A (potentially aligned with Paris) to H (furthest from being aligned) based on their cumulative performance.

The company that scored the highest was BP, which received a D grade. Firms like Equinor, Shell and TotalEnergies got an E grade, while ExxonMobil, Petrobras, Saudi Aramco and Pioneer received a G. The worst-performing company on the scorecard – and the only one to get an H – was ConocoPhillips.

Bar Chesapeake Energy, all companies on the list are targeting new developments and production increases in the near term, although in the long term, Repsol, Equinor and Shell are aiming to keep production volumes flat, and only BP is planning for a decline by 2030. Saudi Aramco and ConocoPhillips, on the other hand, expect production to increase significantly (by 43% and 47%, respectively) by the end of the decade.

Mike Coffin, head of oil, gas and mining research at Carbon Tracker, said: “This new scorecard enables investors to assess companies’ actions relative to peers, and to ask tough questions of company leadership on the realities of the energy transition and addressing climate change.”

How investors should assess fossil fuel firms’ climate policies

The analysis comes as the scrutiny of fossil fuel production increases. Last week, a report by international non-profit Global Witness revealed that the emissions from fossil fuel burning until 2050 by Shell, BP, TotalEnergies, ExxonMobil and Chevron could cause 11.5 million premature deaths by the end of the century. Even if the world reaches net zero, that figure would still be 5.5 million.

Meanwhile, advocacy group Public Citizen is now promoting a legal theory that claims fossil fuel companies in the US could be put on trial for homicide for climate-related deaths.

Carbon Tracker outlines the importance of assessing fossil fuel firms’ climate performance, noting that a company can “hardly be considered aligned with a 1.7 ̊C or even 2.4 ̊C future if its business model depends on selling oil and gas”, which naturally threatens climate goals.

It notes that there are other indicators that investors who are seeking improved alignment with the Paris Agreement can consider. This includes targeting zero routine flaring and eliminating methane emissions, scrutinising any plans to continue frontier exploration (which could indicate an intention to expand production), analysing the ratio of capital expenditure on new and existing projects, and asking companies how they justify lobbying activities that hinder efforts to meet the Paris Agreement’s goals.

Among the key questions it suggests investors look into are why companies haven’t set scope 3 emissions targets, their strategies to achieve emissions reduction targets (and whether they’re credible), how they resolve the continued use of growth metrics in executive bonus policies, and why their emissions goals fail to match the framing of the wider corporate emissions targets.

“Combined alignment grades, and scoring across alignment metrics, can direct investors to areas in which they can influence companies to improve their performance, e.g., by voting on remuneration plans during voting season. If a company fails to make progress over time, then investors will need to consider whether or not their investment is compatible with their own investment objectives,” the report states.