5 Mins Read

The Good Food Institute Asia-Pacific (GFI APAC), a nonprofit supporting the alternative protein ecosystem, has just announced its list of top players in the region’s rapidly growing industry. Titled “2020 Asia Alt 100”, the list includes startups, organisations, investors, suppliers disrupting the food system, and identifies raw materials and food production as key opportunities for regional players to capitalise on.

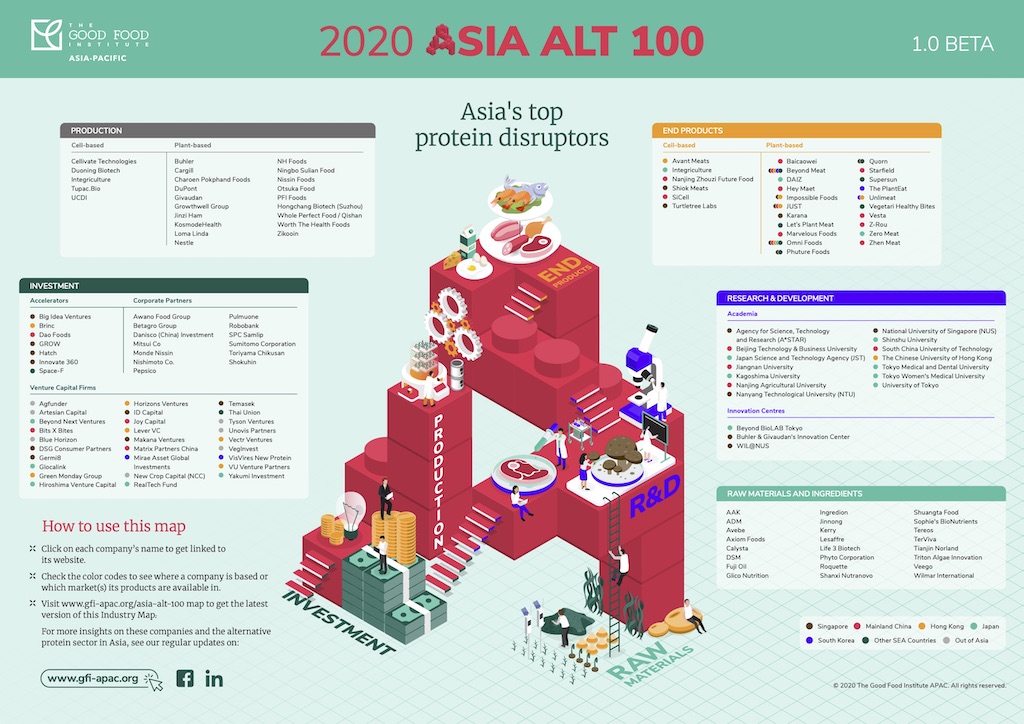

Published by GFI APAC, the Asia Alt 100 list identifies the top hundred players in Asia’s fast-growing alternative protein industry, covering five major markets including Hong Kong, Singapore, Japan, South Korea and mainland China. It does not include India’s emerging new protein ecosystem.

GFI’s research touches on five segments across the supply chain: raw materials and ingredients, food production, research and development, corporate partnership and end products, while retail players are excluded from the list.

According to the analysis, over half (57%) of the 100 players to look out for in the alternative protein industry are corporates. The second largest share is taken up by startups (29%), followed by academic institutes (14%).

While alternative proteins – plant-based and cultivated segments – are still in nascent stages compared to the United States market, GFI analysts believe that there are unique opportunities for growth in the Asia region.

“Coming from a background of very vibrant and diversified food cultures, Asian consumers have a discerning palate and demand for a great variety when it comes to food,” said Elaine Siu, managing director of GFI APAC.

“For alternative protein to truly become a protein solution for Asia, the industry needs to move beyond importing technologies and brands from Silicon Valley. We need homegrown players who understand and can cater to the local markets’ taste.”

There are already a number of local innovators emerging in the region over the past year, which Siu described as having “huge potential to lead the future growth of this sector”. Among some of the food tech startups listed include Hong Kong’s cultivated fish maw company Avant Meats, Japan’s cellular tech startup IntegriCulture, Singapore’s Shiok Meats and TurtleTree Labs and maker of acclaimed plant-based pork analogue OmniFoods.

Many of these had been previously featured in the Asia Alternative Protein Industry Report, which drew on data from over 50 extensive discussions, including 35 one-on-one interviews with alternative protein stakeholders across 6 countries in Asia, and concluded that the region could become the first to launch a commercially available cultivated protein product.

Alongside the list of 100 top players, GFI APAC also presents an industry map with 35 key investors in the field helping to propel the development of alternative protein. The majority of investors are headquartered in Singapore, followed by Hong Kong, Japan, mainland China and South Korea.

Among them are Singapore and New York-based Big Idea Ventures, which has backed Shiok Meats, Beijing-based vegan meat startup Zhenmeat, and most recently India’s first plant-based egg company Evo Foods. Brinc, Dao Foods and Space-F are also listed as key accelerators supporting the food tech startup ecosystem.

Identifying the segments within the industry poised to create the most opportunities for innovation and growth, GFI APAC says that raw material and ingredient supply as well as food production are the top two to look out for.

“While major consumer brands and retailers launching the ‘next plant-based burger’ have been getting the spotlights, as the industry matures, we have seen investors showing increasing interests in raw materials and ingredients suppliers and B2B companies,” explained Siu.

GFI’s analysis shows that the raw material and production stage of the value chain is only beginning to catch up to the potential for growth in the upper-streams of innovation and research into plant-based and cultivated protein alternatives.

Leveraging Asia’s existing strong soybean and pea production can provide a key pathway for the region’s new protein ecosystem to flourish, particularly in terms of bringing down production costs and making products widely affordable and accessible to the mass market.

“It is expected that more and more Asian companies will enter the industry as the local players start to realize the competitive advantage they have in growing raw materials, processing ingredients, local distribution network, supply chain infrastructure, and of course, in creating products that are tailored to the variety of Asian palate and culture,” said Siu.

Mainstream consumers in Asia have shown increased interest in plant-based meat alternatives in recent months, particularly as the dual issues of coronavirus and livestock disease outbreaks such as the African swine fever and Div1 shrimp virus continue to heighten food safety and health concerns.

But even prior to the pandemic, consumers in Asia had begun to couple food choices and its environmental impact, with growing numbers of plant-based eaters and flexitarians citing animal agriculture’s colossal carbon footprint and pollution as a key reason for changing consumption habits.

For many industry onlookers – consumers, manufacturers and investors – the time has never been so ripe for the Asia alternative protein industry to explode, as global crises have shown the urgent need for a transformation into a more sustainable and resilient food system.

Read: Q&A with founder and executive director of GFI Bruce Friedrich on ending animal agriculture

Lead image courtesy of OmniFoods.