Global Alternative Protein Investment Triples To US$3.1 Billion In 2020 With Asia Surge, New GFI Data Reveals

5 Mins Read

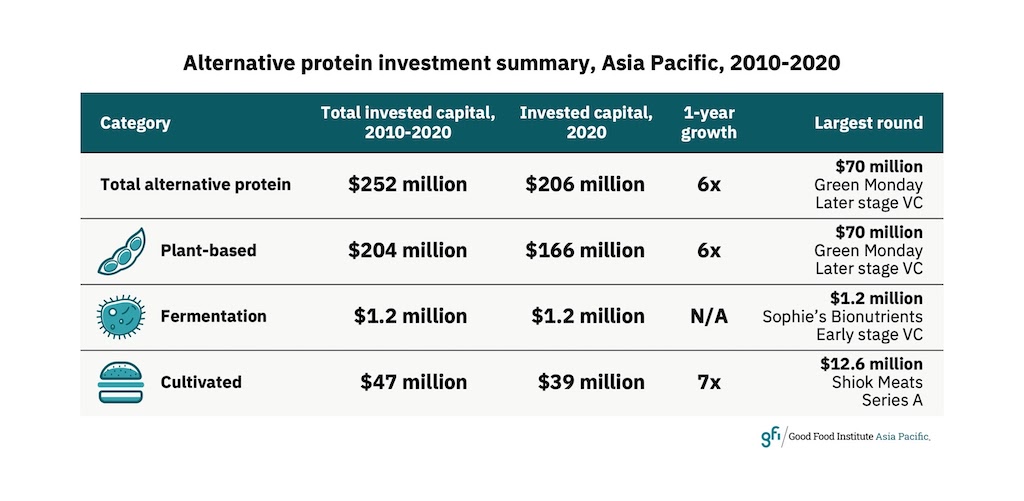

Globally, US$3.1 billion was invested into alternative proteins in what was a record year for the industry in 2020, marking a tripling of the figure in 2019. The data, published by the Good Food Institute (GFI), also showed the enormous growth of the sector in Asia-Pacific, with the capital raised in the region increasing more than six-fold year-on-year.

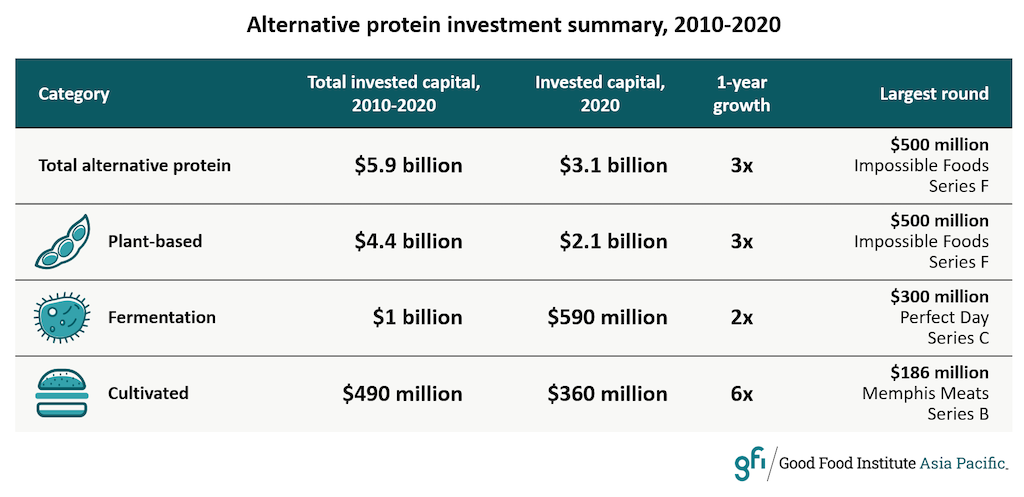

New GFI data released on Thursday (March 18) shows that investment into alternative proteins reached an all-time high in 2020, topping a record US$3.1 billion. It represents a tripling of the US$1 billion investment the industry attracted in 2019, and more than half of the total US$6 billion sum raised by companies developing animal-free alternatives over the past decade between 2010 and 2020.

The investment activity was tracked by GFI using PitchBook data of global plant-based meat, egg and dairy alternative firms, as well as cell-based and fermentation alternative protein companies, totalling more than 550 entities.

“2020 was a breakout year for alternative proteins, with record investment flowing into all segments of the industry,” remarked Caroline Bushnell, director of corporate engagement at GFI. “This is yet another signal of the significant potential the private sector sees in this rapidly growing global industry.”

2020 was a breakout year for alternative proteins, with record investment flowing into all segments of the industry.

Caroline Bushnell, Director of Corporate Engagement, GFI

While global figures were impressive, the surge in investment into Asia-Pacific was even more pronounced, with GFI data showing that capital raised in the region grew six-fold year-on-year. A previous report published by Green Queen Media and Future Food Now founder Michal Klar, which tracked investment into Asia’s alternative protein industry from mid-November 2019 through mid-November 2020 placed the figure at US$230 million, in a strong show of the bullish sentiment of the opportunities to be made in key Asian markets.

Commenting on the findings in the latest GFI report, Mirte Gosker, acting managing director of GFI APAC, said: “The acceleration of alternative proteins in Asia Pacific has arrived, and not a moment too soon, because conventional meat production is ill-equipped to handle the escalating pressures of skyrocketing protein demand, increased climate disruption, and threats of viral outbreaks.”

The acceleration of alternative proteins in Asia Pacific has arrived, and not a moment too soon.

Mirte Gosker, Acting Managing Director, GFI APAC

“This clear vote of confidence for smarter ways of making meat signals the beginning of a seismic shift, but to fulfill countries’ net-zero emission pledges and deliver increased food security, we need governments to match the enthusiasm of the investment community by redoubling their support for plant-based and cultivated meat R&D,” Gosker continued.

In the sector-by-sector breakdown of the investment activity in alternative proteins, GFI data showed that plant-based firms brought in the majority of the capital raised, with companies in the category receiving US$2.1 billion over 2020, again representing around a three-fold year-on-year increase from the US$667 million figure of 2019.

Some of the highlighted milestone rounds driving the enormous flows of capital into the plant-based sector include Impossible Foods’ record-breaking US$700 million combined total from its Series F and Series G and Oatly’s US$200 million Blackstone-backed round.

Cultivated food techs, on the other hand, saw its investment total US$360 million in 2020, six-times more than the amount invested in 2019 and representing an astonishing 72% of the industry total from 2016 to 2020. Key financing rounds in the category include Dutch cell-based beef pioneer Mosa Meat’s US$75 million Series B, and Memphis Meats’ US$186 million round.

The investor community is waking up to the massive social and economic potential of food technology to radically remake our food system.

Sharyn Murray, Senior Investor Engagement Specialist, GFI

2020 further marked a landmark year of investment for the rising “third pillar” of alternative protein: fermentation. Companies in the sector bagged US$590 million, doubling the amount from the year before, driven by animal-free dairy protein maker Perfect Day’s US$300 million Series C, and Bill Gates-backed Nature’s Fynd, who brought in US$45 million.

Sharyn Murray, senior investor engagement specialist at GFI, believes that the overall trend was driven by the wake-up call brought on by the pandemic-stricken year, which exposed the vulnerabilities of the food system, and the need for solutions if we are to avoid the human and planetary health consequences that will come with intensifying climate change.

“The investor community is waking up to the massive social and economic potential of food technology to radically remake our food system,” explained Murray. “Early trend setters like Impossible Foods, Beyond Meat, Memphis Meats, and Mosa Meat continue to perform well, and there are more and more entrepreneurs who see the potential of alternative proteins to succeed in the marketplace.”

Lead image courtesy of Impossible Foods.