Pandemic Recovery, More Brands & Price Parity: Here’s How Australia’s Plant-Based Industry is Doing

10 Mins Read

Despite a downturn in investment and economic contribution, sales of plant-based meat in Australia have grown from pre-pandemic levels, with a greater number of brands and a smaller price gap with conventional proteins. Food Frontier CEO Simon Eassom and report author Klara Kalocsay explain why.

Plant-based meat is inching closer to the cost of its conventional counterparts in Australia, driven by a proliferation of brands and significant foodservice growth, according to a new report by Food Frontier.

The think tank’s 2023 State of the Industry report combines industry data and insights from Deloitte Access Economics, highlighting the challenges and opportunities faced by the sector after a tricky couple of years globally.

Where has the industry gained, and where is it lacking? What will it look like in the future? Here are the key takeaways from Food Frontier’s analysis.

Foodservice surge offsets retail slide

The rise of plant-based meat in Australia has been driven by its foodservice performance since Covid-19. In 2023, sales across foodservice and retail reached AU$272.5M, representing a 47% increase from 2020, the first year of the pandemic. Per capita consumption is also up by 28% since 2020.

But while retail sales dipped by 1.1% annually, the wholesale demand in foodservice has increased by 59%. This means the latter is now responsible for 45% of the sector’s sales, up from 17% in 2020. Most of these sales (80%) come from quick-service restaurants (QSRs), with the report suggesting manufacturers stand to gain by expanding into new foodservice outlets and across untapped segments.

“The foodservice sector has come from a very low base, so growth has always had significant potential. Australians eat out a great deal as part of their culture. With plant-based meats becoming more popular and well-known, QSRs and other service outlets have been able to rapidly introduce non-meat alternatives into their menus very simply and without significant input into chef education,” Food Frontier CEO Simon Eassom told Green Queen.

He cited the ease of offering meatless versions of traditional choices like plant-based burgers or an Aussie breakfast with vegan bacon and sausages as an example. “There is evidence that consumers are more willing to try something new in a service setting and, particularly if one member of a group or family doesn’t eat meat, QSRs have recognised the value of catering for the requirements of the whole group,” he added. “Hungry Jacks (Australia’s version of Burger King) has seen this value when introducing the ‘Rebel Whopper’ as its plant-based version of its meat offerings.”

Eassom continued: “The retail sector grew very quickly before the pandemic and has suffered inevitable contractions, readjustments and corrections. Whilst the leading brands have consolidated or grown their market share, other brands have contracted or disappeared, so the overall growth trajectory through the financial difficulties of the past few years has been relatively flat, but there are strong signs of recovery,”

When you look at mid-term trends, the industry has steadily grown from pre-pandemic levels, with retail sales swelling by 9% annually since 2019, and foodservice expanding by 37%.

The industry’s economic contribution is down

Despite the market performance, the plant-based meat manufacturing sector’s contribution to the economy has reduced by 9%, from AU$50.4M in 2020 to AU$45.8M last year. This drop is witnessed across both direct and indirect contributions.

One of the major factors behind this was a slight contraction in domestic manufacturing in the first half of 2023, stemming from a lack of investment and grant funding, rising manufacturing and labour costs, and reduced consumer expenditure.

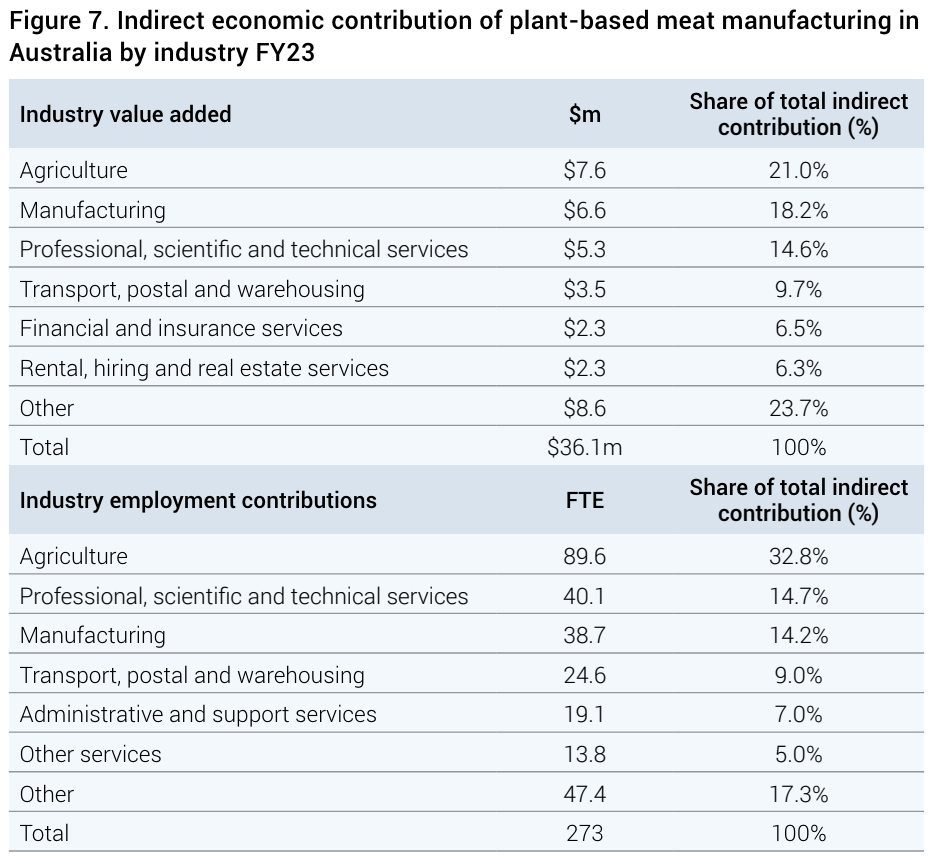

When it comes to indirect employment, plant-based meat’s contribution dipped by 9% as well. But it’s largely benefitting the agriculture, manufacturing and professional services industries, which account for 33%, 15% and 14% of the total.

“This agricultural potential remains largely untapped, primarily due to the absence of sufficient infrastructure for processing domestic plant proteins. Expanding domestic production and increasing the availability of Australian-grown plant protein ingredients present promising economic prospects for Australian farmers,” explained Klara Kalocsay, head of research strategy at Food Frontier, and the report’s author.

“There is substantial demand within the domestic plant-based food sector and in international export markets for Australian protein ingredients. Of course, the capital outlay to construct processing facilities is considerable and will likely require co-investment, either in consortiums or public-private partnerships to fund construction,” she added.

“Australia is seen throughout Asia as a supplier of reliable, safe and high-quality foods and food ingredients. With an increased number of facilities able to produce the ingredients and the incentives needed to convert commodity crops into high-value products, the economic and employment contribution from the sector will continue to grow.”

Investment mirrors global trends, but brand options increase

Globally, plant-based companies saw a 28% decline in VC investment in 2023, reflecting the larger 61% drop in food tech funding. The pattern is similar in Australia, where plant-based meat makers have witnessed a 70% decrease in financing since 2020, and a 13% drop from 2022, reaching AU$16.75M last year.

However, the number of companies producing vegan meat analogues increased from 10 in 2019 to 22 in 2023. As Food Frontier outlined in its supermarket audit released in February, this has given rise to an explosion in the number of products, which went from less than 90 in 2020 to 275 in January 2024.

In fact, this figure peaked at nearly 350 in 2023, but consolidation in the category (with mergers like The Aussie Plant Based Co.) brought about a rationalisation of SKUs. “The industry could expect investment to drop further if the current economic climate continues. However, manufacturers are moving beyond the early days of requiring injections of capital from investors and seeing greater returns on collaboration, market expansion, mergers and acquisitions,” said Eassom.

“We anticipate any future investment in plant-based meat to mostly revolve around initiatives that add value to the industry by way of taste and texture – technologies and developments that help to improve the quality of the product and/or make it cheaper, thus addressing consumer barriers.”

Burgers give way to chunks, strips and crumbed formats

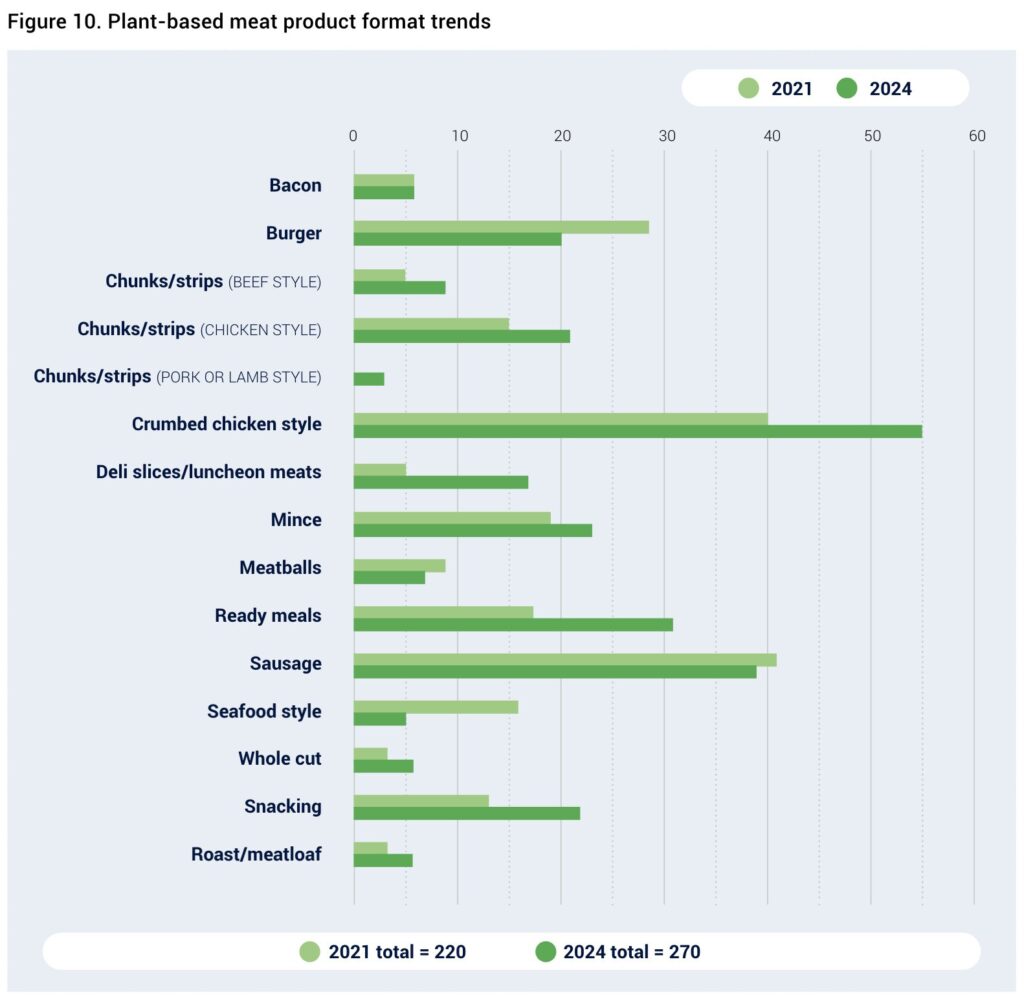

Australia has witnessed a shift in consumer preference for the type of plant-based meat. Long-standing formats like burgers and mince have stabilised in number, while newer options such as strips/chunks and whole cuts have become more popular.

Crumbed chicken, deli meats, ready meals and snacking SKUs have all expanded too, pinpointing a preference for convenience. Meanwhile, vegan seafood products have fallen sharply. Additionally, the number of frozen products has increased by 10%, making up just over half of all products on shelves.

And 63% of these products are from Australian companies (up from 42% in 2020), with 48% being manufactured domestically.

“Consumers are looking for convenience, which has seen a significant increase in the supply of formats like schnitzels and nuggets, through to mince and meatballs, and to deli slices, snacking and finger foods,” Eassom outlined. “In addition, recreating the taste and texture of beef-style products – particularly chunks and strips – is more challenging than producing a crumbed or battered product where flavours can be added through the format.

“‘Southern-style’ flavourings, for example, have a greater impact on the flavour experience than the plant-based meat or animal meat itself. Such formats are readily available with animal meat through fast-food outlets and QSRs, so there is greater public acceptance.”

Plant-based meat closer to price parity

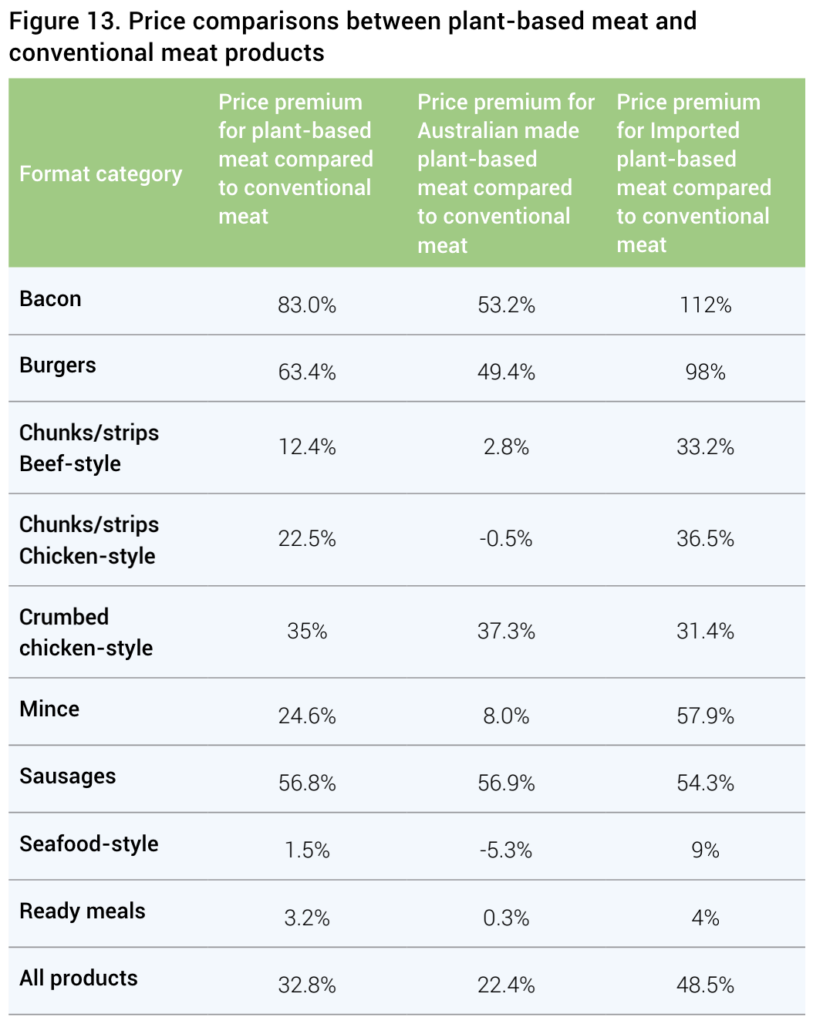

Despite increased per capita spend amid inflation and the cost-of-living crisis, the price gap between plant-based and animal-derived meat is narrowing. While the former carried a premium of 49% in 2020, they were just 33% more expensive last year.

Vegan seafood and ready meals are almost at price parity, with only a 1.5% and 3.2% markup, respectively. On the other end of the spectrum, bacon (83%) and burgers (63.4%) carry the largest price premium.

But domestically produced plant-based meats are universally cheaper than imported products, representing a 14.8% difference. This also translates to cost-competitiveness with animal proteins, with the gap in ready meal prices down to an even smaller 0.3%, and beef chunks/strips (2.8%) and mince (8%) approaching parity too. In fact, Australian-made vegan seafood and chicken chunks/strips are actually cheaper than their conventional counterparts, costing 5.3% and 0.5% less.

“Some Australian manufacturers said they absorbed price hikes whenever feasible to shield consumers from bearing the brunt, recognising the role of pricing in consumer decision-making,” explained Eassom. “And some companies improved efficiencies in their supply chain, while others pursued vertical integration to reduce overall expenses. Another contributor to the narrowing of the price gap is the departure of several imported plant-based meats, which were more expensive per kilo than locally produced products.”

That said, regular retail prices of plant-based meats are still too high for consumers, with a 7.4% increase in cost across the board. Bacon (+27.5%) and sausages (+26.6%) have had the highest hikes (the former is the most expensive meat analogue in the country), while snacking products (21.1%) and beef chunks/strips (10%) have had the biggest price drops.

“It is worth noting that pricing is controlled by the retail sector as much as by the manufacturer and with relatively low volume sales, the margin demanded by retailers necessarily affects the RRP,” noted Eassom. “As volume of sales increases, the potential reduction in margins should see price parity grow closer.”

“If overseas trends are anything to go by, we think the Australian market, when it can, will see even closer price parity,” he added. This could happen in several ways: retailers could introduce a policy of increasing plant-based food sales and sell their products at price parity, something European chain stores are doing; manufacturers will likely become more efficient in making products (many are still young companies and improving scaling costs); and local production could be expanded, driving prices further down.

Health the largest driver, taste the biggest detractor

Research shows that 20-39% of Australians are cutting back on meat or eating none at all, with 38% open to replacing it with a plant-based option. Health seems to be the major influencing factor, with protein requirements and ultra-processing top of mind. After consulting with manufacturers, Food Frontier found that they are prioritising health and nutrition in plant-based meat production.

This is followed by price, thanks to the higher cost of living. High costs are also a deterrent, as is the taste of these products, which is the tallest barrier for plant-based meat purchases. “In line with most comparable markets, Australian consumers who consciously plan their diet say that health and nutrition are key drivers for their dietary decisions and corresponding purchasing behaviour. These rate higher, for example, than environmental issues or animal welfare (vegan consumers excepted),” said Kalocsay.

“Interest in plant-based meat is less driven by the positive perception of the nutritional benefits of plant-based meat and more by a growing concern of the negative effects of red meat consumption, deli-meat consumption, saturated fat, and lack of fibre in our diets,” added Eassom.

It means consumers are still not big on the environmental benefits of plant-based meat. due to a lack of press coverage – only 5% of Australian media stories mentioned the impact of food on climate change between 2011 and 2021.

The road ahead

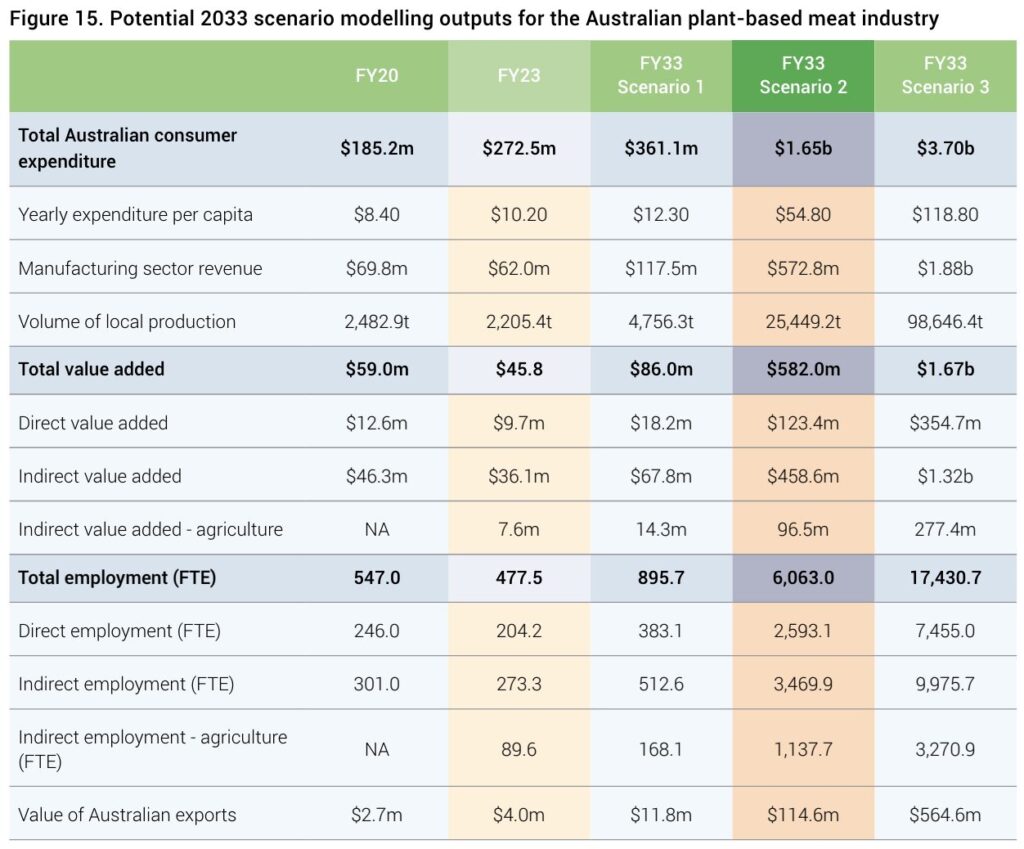

In Food Frontier’s first State of the Industry report, Deloitte Access Economics modelled three potential 10-year scenarios for the plant-based meat manufacturing industry. These are based on three trajectories. The first centres on these products as conscious consumers’ choice, a conservative estimate; the second is a moderate forecast labelling vegan meats as popular and accessible alternatives; and the third, more accelerated prediction analyses these as popular mass-market commodities.

But the change in market size from 2019 to 2023 is not on track to meet the potential scenarios outlined in its first such report, thanks to “a confluence of macroeconomic trends”, “supply chain factors specific to the food manufacturing sector industry”, low repeat purchases due to poor experiences with early meat analogues, and assumptions that behaviour change would be much faster.

“Some products were not meeting consumer expectations around taste, and the higher price point compared to conventional counterparts has reduced repeat purchases, leading to a revised forecast value,” explained Eassom.

The first scenario now predicts sales to reach AU$361M by 2033, a conservative estimate accounting for 896 full-time equivalent (FTE) jobs. The second forecast – representing increased R&D and infrastructure investment, reduced import reliance and lower meat consumption – would mean sales hitting $1.65B, with 6,063 FTE jobs. The third and most aggressive scenario, meanwhile, will see 17,430 FTE jobs and sales of $3.7B by 2033.

“Scenario two is considered the most likely to play out. It depicts a steady growth path until 2033, mirroring the ongoing medium-term trends observed over the past five years, particularly the robust growth from FY19 to FY20,” said Eassom. “Within this scenario, moderate growth is seen across both the retail and foodservice sectors in the category, with a parallel increase noted in the domestic plant-based meat manufacturing industry.”

He added: “There is limited further growth from the early adopters and diet evangelists. The challenge is to normalise the consumption of plant-based meat alternatives as an occasional part of the diet of flexitarians. Scenario two models two variables (number of consumers and frequency of consumption) that we believe represent achievable growth trajectories.”