4 Mins Read

Chinese plant protein company Baichuan Bio Tech is preparing for an IPO, having registered for consultation with the Zhejiang Securities Regulatory Bureau.

Baichuan Bio Tech, a plant-based manufacturer specialising in soy fibre protein, is preparing for an IPO in China, and has registered with the Zhejiang Securities Regulatory Bureau for guidance on going public.

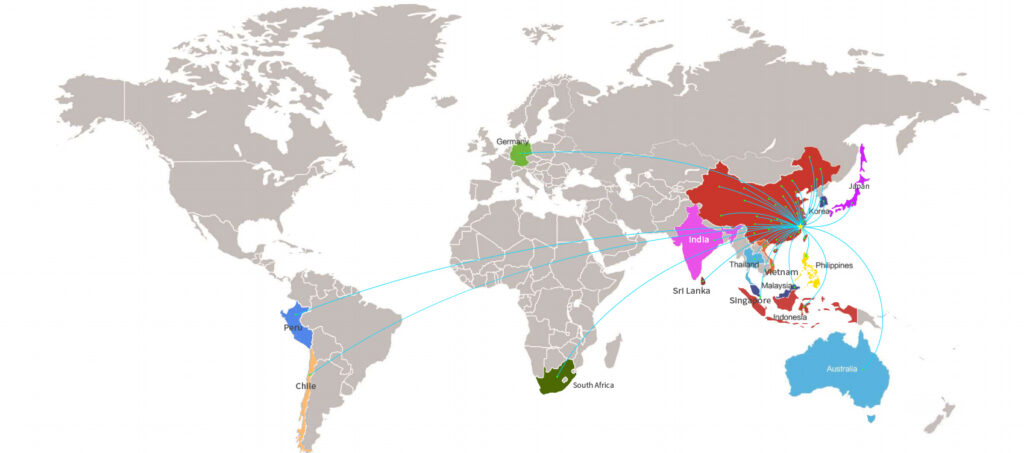

Founded in 2008, the Wenzhou-based company is a protein solutions provider and tech leader combining R&D capabilities, production and sales. The company’s product portfolio traverses multiple categories, including plant-based meats, frozen foods and snacks, and its partners serve 32 countries and regions globally.

Its flagship dehydrated soy protein uses proprietary techniques to mimic the texture of muscle fibres, which allows plant-based meats to closely match the texture and nutritional value of their conventional counterparts, while significantly reducing fat and cholesterol content.

These speak to the ever-evolving attitudes of China’s consumers, whose dietary habits have become more health-skewed of late. BiaChuan founder Chen Biao explained the three-step transition, progressing from addressing hunger, to pursuing quality, to now emphasising health. A 1,206-person study from 2022 found that health is the strongest driver of plant-based meat purchases for Chinese consumers.

And it’s not just in China – this change is being seen across the world, with nutrition becoming increasingly more important to people, especially when it comes to plant-based food.

BaiChuan’s manufacturing prowess

BaiChuan has two major production sites in Wenzhou and Henan, with a capacity of 80,000 tonnes annually. The former facility features fully automated workshops and focuses on high-end products for catering and exports, while the latter is said to be the largest plant protein manufacturing base in China, equipped with a fully automated production line to produce meat analogues, frozen foods and snacks.

The company claims its textured soy protein has a clean taste and superior mouthfeel, and boasts high functionality for plant-based meat applications, which include dishes like spaghetti, nuggets, burger patties, sauces and tinned meats.

It has made several strides in its facilities by upgrading to twin-screw extruders, boosting the performance and production formula of plant proteins and developing over 30 varieties of its soy protein with more than 100 specifications. In total, the company holds 51 patents for its technologies.

For its foodservice products, the manufacturer has developed products like plant-based edible bird’s nests, cubes, slices and granules, which instantly expand after physical extrusion for 10 seconds, preventing nutrient loss and overheating. These products have no cholesterol, sugar, additives or fat, and contain thrice more protein than beef, responding to consumer needs for more nutritionally dense plant-based meat.

Global clientele and future-facing product development

BaiChaun says its products are geared towards vegans, vegetarians and flexitarians. A ProVeg International survey from last year found that 19.3% of Chinese Gen Zers are flexitarians, while 65% know about plant-based meat and 35% are willing to purchase these products.

With nearly 500 employees, the company racked up nearly 500 million yuan ($6.9M) in sales in 2020, and has total assets worth 265 million yuan ($3.6M). This is aided by its roster of 1,300 clients, which includes large companies like Shuanghui, Jinluo, and Yanjinpuzi. In fact, 500 of these are overseas customers from the likes of Germany, Australia, Malaysia, Indonesia, the Philippines, Vietnam, and more.

But while it’s known for its soy protein, BaiChuan is also using 18 types of native ingredients including wheat, peanuts, peas, flaxseed, carrots, pumpkins, buckwheat, red beans and ginseng to form a new generation of plant protein productions developed by China Agricultural University professors.

A report by alternative protein think tank Food Frontier last year found China to be the most favourable market for plant-based food in Asia-Pacific. But high price remains a key barrier, with analysis from Asymmetrics Research showing that many middle-income Chinese consumers are looking for better-value products.

“In the post-pandemic era, consumers are placing greater emphasis on nutritional value and affordability,” said Jeremy Yeo, acting general manager of the China division of Beyond Meat, which is listed on the New York Stock Exchange. “Additionally, there’s a pronounced shift towards products that prioritise health, flavour and environmental sustainability. ‘Green’ and eco-friendly options are not mere trends; they mark a profound evolution in consumer tastes and values.”

There is policy support too – in February 2023 the annual Central No. 1 Document mentioned a diversified food system of animals, plants and microorganisms. And in May 2022, China’s 14th five-year plan for bioeconomy development highlighted an advancement of synthetic biology, and exploration of man-made protein and novel foods – two months after President Xi Jinping called for a Grand Food Vision that included the plant-, microorganism- and animal-based protein sources.

BiaChuan claims it accounts for over 40% of the domestic market share for plant proteins – with its impending IPO, it will hope to capture the stock market the same way.

In the US, Impossible Foods is also weighing up a possible IPO, after its CEO Peter McGuinness said the company is targeting a liquidity event in the next few years.