7 Mins Read

Analysis by alternative protein think tank the Good Food Institute (GFI) Europe reveals how value-added tax (VAT) on plant-based milk alternatives creates a disparity with their conventional counterparts. But there are calls to level the playing field.

Ever since plant-based milks popped up on our grocery lists, latte orders and news feeds, there has always been one complaint – both from vegans and dairy drinkers. These things are expensive.

At least most of them – especially the branded ones – are. Sure, exceptions like Lidl’s now cost-comparable alt-milks in Germany exist, but for the large part, milk alternatives continue to carry a price premium over conventional dairy.

If anything, these markups have increased post-pandemic thanks to inflation. In the UK, for example, a carton of Oatly’s Barista edition used to be £1.80 for the longest time – now, it’s £2.10. Similarly, Alpro’s regular soy milk was £1.50 at one point, but now costs £2. This isn’t just anecdotal – analysis by the Grocer revealed that 32 Alpro products saw price increases of over 5% in a five-week period ending September 2022. Overall, the price of alt-milks in the UK is 13-14% higher this year.

And yes, dairy is also more expensive, with a pint of milk costing 62% higher in September than in January 2022 at Morrisons, and two points setting you back as much as four pints did in most supermarkets in the same period. Despite all this, conventional milk and dairy products are largely cheaper than their plant-based counterparts.

There are multiple reasons for this. The sheer scale of the dairy industry – in Europe, alt-milk commands only 11% of the market share – means it can mass-produce milk at a much cheaper cost. Government support in the form of subsidies is another massive factor: in the EU, meat and dairy farmers receive 1,200 more public funding than alt-protein companies, while half of cattle farmer incomes come directly from government subsidies. Then there are the tax disparities, which is what GFI Europe has focused on in its analysis of the VAT attached to vegan milk products.

How VAT for food products works in Europe

It would be remiss not to note that plant-based milk sales have risen by 7% from 2021-22 in Europe, according to NielsenIQ data crunched by GFI Europe. Between 2022 and 2022, meanwhile, the value of the vegan milk market has swelled by 19% – almost double the growth of cow’s milk. In terms of unit sales, the former saw a 20% increase, while the latter saw a 9% fall.

And even in terms of price hikes, the data revealed that alt-milk markups were up by 1% year-over-year, but conventional milk witnessed a 17% spike. Still, cow’s milk reigns supreme on the cost front, with vegan alternatives continuing to be more expensive despite these trends.

In 2019, ProVeg International published a Plant Milk Report that revealed six countries – Austria, Germany, Greece, Italy, Slovakia, and Spain – have “significantly higher” VAT on alt-milk in comparison to its conventional counterpart. The organisation called this disparity “discriminatory”, adding that “people want a fair playing field for plant-based products”. This is reflected in the findings of the 2023 EU Smart Protein survey, which revealed that price is the biggest barrier (cited by 38% of the 7,500 respondents) to the adoption of plant-based alternative foods.

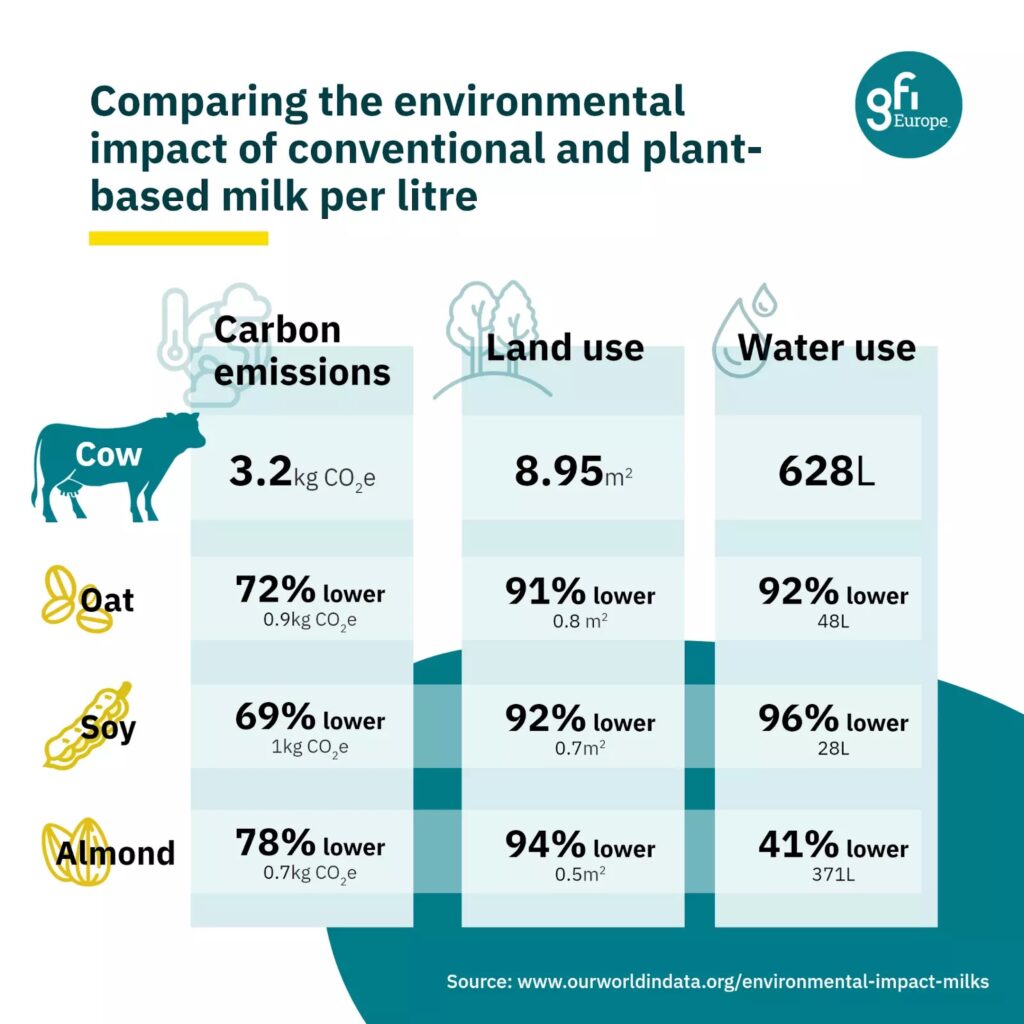

ProVeg argued that there should be a level playing field – if not one more favourable to vegan products – because of the environmental impact of dairy. Compared to soy milk, producing cow’s milk emits 69% more emissions, requires 92% less land, and uses 96% less land, according to a 2018 study.

GFI Europe makes the same point. Explaining that governments may apply a lower VAT rate or even an exemption on products it wishes to incentivise consumers to buy. For instance, in Germany, most products carry a 19% levy, but certain ‘public good’ items (like books, water, medical care and food staples) have a lower 7% surcharge.

Countries that charge a higher VAT for plant-based milk

While VAT varies greatly by country, in the EU, standard rates must be at least 15%, and reduced rates (excepting some exemptions) need to be a minimum of 5%. In terms of plant-based milks, a VAT gap with conventional milk is “the exception, not the rule in Europe”, as GFI Europe states, with a majority of countries – including the UK and most of the EU27, taxing both at the same rate as they’re classed as staple foods.

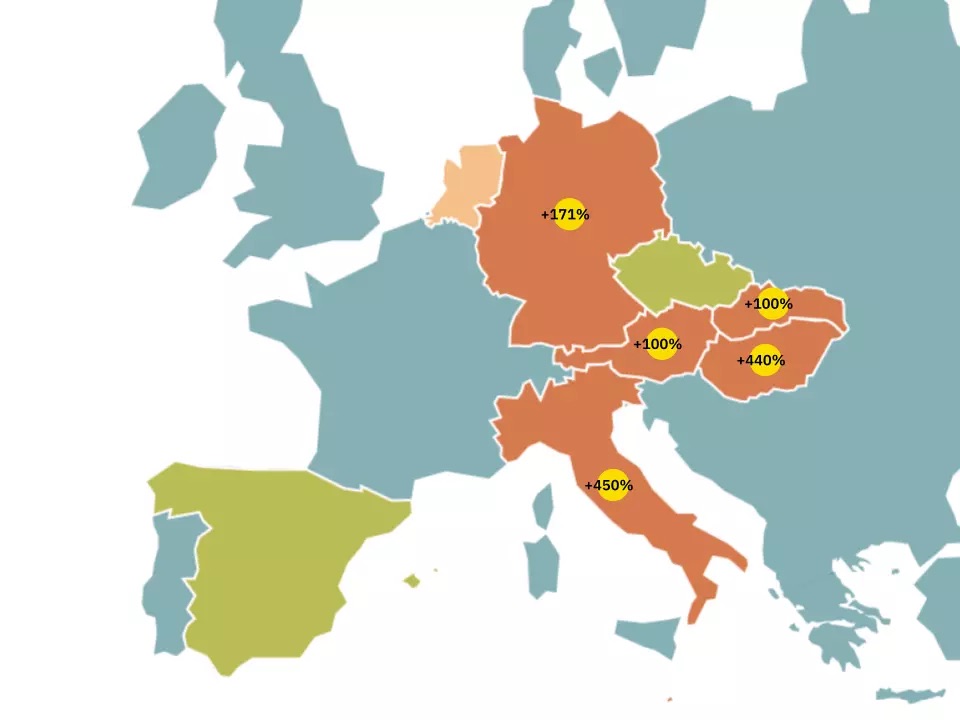

But other nations have a broad discrepancy here. For instance, despite leading Europe’s alt-milk market, Germany has the third-largest VAT gap, with plant-based milk carrying a 19% levy compared to 7% for cow’s milk. The only other countries with a bigger disparity are Hungary (5% for dairy milk vs 22% plant-based) and Italy (4% vs 22%, respectively). Meanwhile, Slovakia and Austria have identical VAT rates, charging 10% for conventional milk and 20% for vegan.

Spain is a tricky one to predict. Until recently, alt-milk faced a 10% VAT while conventional milk was subject to 4%. But the country’s efforts to tackle rising food prices meant VAT was scrapped from essential foods at the start of 2023, which included both these sets of milks. Initially a temporary measure, it was extended in June, but there’s no clarity over the future of these charges.

The Netherlands is going backwards. While both milks carry an identical VAT rate of 9%, the levy on plant-based milk is set to increase by 196% from January 1 due to an oversight in a new consumption tax targeting fizzy drinks, leading to a massive increase in VATs for all vegan dairy alternatives (except soy milk).

Calls for parity and success stories

The Dutch legislation aims to discourage unhealthy foods and will apply to most non-alcoholic drinks, but not cow’s milk, which has been exempted as it’s considered a healthy food. That hasn’t carried over to the plant-based milk category, which has seen criticism being levelled at policymakers, especially cow’s milk products like milkshakes will be exempt from the tax, while low-sugar plant milks will carry the additional VAT.

Some groups have begun campaigning against the exclusion of plant-based milk. And this can be seen across Europe. In Slovakia, sustainable food advocacy organisation Jem pre Zem has launched a petition calling on the government to introduce VAT parity for plant-based milk, while in Austria, similar calls have come from groups including Vegane Gesellschaft Österreich and retail giant REWE.

There’s also legislative pressure in certain quarters. German MPs Tim Klüssendorf (SPD) and Bruno Hönel (Green Party) proposed a change in the country’s tax laws to reduce the VAT on alt-milk and introduce a tariff in the annual tax law negotiations. “With the change in eating habits in recent years and decades, plant-based milk has become an everyday alternative to cow’s milk for many. In addition, it is more climate-friendly,” Hönel told German newspaper Welt am Sonntag.

This is echoed by GFI Europe’s assessment. “Consumers buying plant-based milk usually use in the same way as cow’s milk. If one is a staple food, then so is the other,” the think tank says. “A preferential VAT rate on conventional milk but not plant-based milk penalises consumers making more sustainable choices and unfairly increases costs for those with intolerances and allergies.”

And there is precedent for success here. The Czech Republic closed the gap between the tax laid on cow’s milk and plant-based alternatives, with both carrying a 10% VAT rate. “Closing the VAT gap is a simple step to reduce an unfair disadvantage being applied to a group of products with an important role to play in the future of our food system,” says GFI Europe.

Greece, meanwhile, has also reduced its plant-based milk VAT from a whopping 24% to parity with while cow’s milk, with both carrying a 13% levy now.

“Our system is outdated and needs to be changed,” Klüssendorf said in a LinkedIn post in August. “The equal tax treatment of milk and milk substitutes is long overdue, because it has long been in line with social realities and puts people on an equal footing in their consumer behaviour.”

This story was updated to reflect updated VAT figures for Greece.